Abstract

This article reviews international developments and trends in hypersonic technology in 2023. It systematically summarizes major actions by leading countries in the field, including the United States, Russia, the United Kingdom, France, Japan, Canada, Switzerland, and Iran. Based on official agency releases, authoritative websites, and budget documents, the analysis covers development plans, budget allocations, organizational arrangements, equipment development, technical innovation, test capabilities, industrial capacity, and basic and applied research. The findings indicate that in 2023 global momentum for hypersonic technology remained strong. Hypersonic missiles continued to be a development priority for many countries. Reusable hypersonic vehicles received increased attention and were developed at an accelerated pace. Test capabilities were enhanced and industrial foundations strengthened, supporting long-term hypersonic technology development.

Keywords: hypersonic; missile; reusable hypersonic vehicle; test capability; industrial capacity; basic research

Introduction

In 2023, major countries continued to intensify hypersonic technology development. The United States adjusted the air-launched hypersonic missile approach and delayed some ground-based deployments. Russia deployed the Zircon hypersonic missile and repeatedly used the Kinzhal hypersonic missile during the Ukraine crisis. The United Kingdom established a hypersonics capability development framework to accelerate weapon maturity. France completed the first flight of a hypersonic glide vehicle. Japan formally initiated development of two hypersonic missile types. India showed new signals in hypersonic cruise missile research, and Iran unveiled two hypersonic ballistic missiles. The United States, Canada, and Switzerland continued hypersonic aircraft programs. Overall, most countries are in a critical weaponization phase for hypersonic missile technology; greater emphasis is being placed on reusable hypersonic vehicle technology and on accelerating technology validation and system development.

1. United States: Building a Hypersonic Ecosystem and Accelerating Weaponization and Innovation

In 2023, the U.S. experienced setbacks in boost-glide hypersonic development, with the Air Force's wave-rider glide vehicle program shelved after multiple full-stack test failures, and the Army canceling key pre-deployment tests for a dual-cone glide vehicle, delaying planned ground deployments. The Navy continued platform modifications to prepare for hypersonic missile integration. In contrast, U.S. hypersonic cruise missile efforts progressed: Air Force and Navy hypersonic cruise missiles completed preliminary design reviews and moved into engineering development. Hypersonic aircraft development accelerated, with prototype ground tests underway and flight tests planned. The U.S. also expanded foundational and applied research across structures, materials, propulsion, guidance and control, and thermal management; increased ground and flight test capacity to close capability gaps; and strengthened industrial foundations to support future low-cost mass production of hypersonic vehicles.

1.1 Prioritization and Weaponization

In October 2023, the Under Secretary of Defense for Research and Engineering characterized hypersonic weapons as high-speed, highly maneuverable, and capable of delivering high-yield payloads, and emphasized that the United States must invest to maintain its technological edge. He outlined priorities: cultivate skilled personnel to manage hypersonics projects; strengthen partnerships among industry, universities, and government to transition systems from development to battlefield use; adopt more agile collaboration with industry; and better align capabilities with operator needs[1].

1.2 Sustained High Funding for Hypersonic R&D

The FY2024 defense budget request allocated $4.572 billion for hypersonic-related efforts. With a House appropriation of an additional $476 million for FY2024 hypersonic programs, the total amounted to $5.049 billion, slightly below the FY2023 enacted level of $5.126 billion but still high. About $2.075 billion of the budget was for hypersonic strike weapon technologies, representing 45.4% of the hypersonics budget, indicating that hypersonic strike weapons remain a development focus.

1.3 New Organizations and Top-Level Coordination

In March, the U.S. House announced a restart of a "Hypersonics Core Group" to help Congress better understand existing hypersonic work and support modernization of hypersonics-related research and test facilities[3]. In August, the Defense Department's Office of Industrial Base Policy established the Innovation Capacity and Modernization team (ICAM) to guide government investment supporting emerging hypersonics developers, improve hypersonics supply chains, strengthen ties with national labs and universities, and reduce production costs by 30%–80%. ICAM targets five hypersonics subdomains: thermal protection systems, additive manufacturing for scramjet engines, cables and wiring, glidebody subsystems, and integrated forgings and castings, and will pursue equipment purchases, process optimization, and workforce training to reach goals[4].

1.4 Hypersonic Missile Development and Platform Integration

(1) Boost-glide hypersonic test failures delayed deployments and led to program changes. In March, September, and November, the Army's "Long-Range Hypersonic Weapon" attempted three Joint Flight Checks but canceled them due to component issues discovered during preflight checks, so deployment goals were not met by the end of 2023[5]. The Air Force's "Air-Launched Rapid Response Weapon" suffered three full-stack test failures; the Air Force decided not to procure that missile[6-7].

(2) Hypersonic cruise missile maturation progressed. DARPA completed a second free-flight test of Lockheed Martin's HAWC demonstrator, launched from a B-52H, flying at about 18 km altitude for roughly 556 km at speeds above Mach 5. DARPA in July awarded a $81 million contract increase to Raytheon for HAWC to advance technology maturity[8]. DARPA also awarded Raytheon $29 million for the Gambit program in September, which is powered by a rotating detonation engine (RDE) and aims to improve fuel efficiency, range, and speed for a weapon expected to be air-launched from a fourth-generation fighter[9-10]. The single-use HAWC-like demonstrator Mayhem is led by Leidos with multiple partners, and institutions such as Draper and Michigan are developing model-based engineering and virtual ecosystems to support it[11-12].

Regarding service programs, the Air Force is progressing the Hypersonic Attack Cruise Missile (HACM) and the Navy the Hypersonic Air-Launched Offensive Anti-Ship Missile (HALO), seeking deployments in 2027 and 2029 respectively[13]. HACM prototype manufacturing began and subsystem ground tests were reported; the Air Force displayed a HACM demonstrator in September and awarded Raytheon a contract modification of $408 million to support development[15]. The Navy completed HALO preliminary design review and advanced toward engineering development with contracts awarded to Lockheed Martin and Raytheon[16].

(3) Platform modifications for missile integration continued. In February, the Navy awarded Lockheed Martin an initial $1.1 billion contract to integrate a conventionally-armed intermediate-range strike weapon onto Zumwalt-class destroyers, with potential value up to $2.0 billion[17]. Plans include replacing existing 155 mm guns with four vertical launch tubes approximately 2.21 m in diameter, each holding three hypersonic missiles, potentially allowing a Zumwalt to carry up to 12 hypersonic missiles[18]. The Air Force sought new pylons capable of carrying hypersonic cruise missiles, including modifications to the SUU-67/A pylon.

1.5 Progress on Reusable Hypersonic Vehicle Technology and Spaceplane Operations

(1) Hypersonic aircraft prototypes entered ground testing. Hermeus disclosed updates on Quarterma and BlackHorse aircraft. Hermeus selected Pratt & Whitney F100 as the turbine component of BlackHorse's Chimera II TBCC engine. In October, Hermeus began ground testing the Quarterma early demonstrator "Iron Bird" to validate propulsion and ground control systems ahead of planned 2024 flight tests[19]. In November, the Defense Innovation Unit (DIU) awarded $23 million under the HyCAT program to mature propulsion, thermal management, power generation, and mission systems for Quarterma[20]. Hermeus plans sequential development of three hypersonic aircraft: a 12.2 m small demonstrator with Chimera I TBCC and a J85 turbine for 2024 flight; a 13.7 m BlackHorse with Chimera II TBCC and an F100-based turbine for 2025 flight; and a 20-passenger “Kingfisher” airliner for 2029.

(2) A reusable spaceplane, Dream Chaser, was slated for its first orbital launch as soon as March 2024 under NASA commercial resupply contracts; Dream Chaser is a runway-landing reusable spaceplane with a disposable cargo module and will support cargo missions to the ISS[21].

(3) The X-37B orbital test vehicle conducted its seventh mission. Launched by SpaceX Falcon 9 in December, the mission included orbital operations in new orbital regimes, space domain awareness experiments, and materials and biological payload tests.

1.6 Strengthening Hypersonic Test Infrastructure

The U.S. continued to upgrade and build ground test facilities and to develop multiple flight test platforms in 2023.

(1) Ground test facilities. Purdue University brought the Hypersonic and Applied Research Facility (HARF) online in June with a Mach 8 quiet wind tunnel and a hypersonic impulse shock tunnel to better replicate real flight conditions for propulsion and aerodynamic testing[22]. In August, the University of Colorado Boulder established a plasma wind tunnel capable of simulating reentry plasma environments up to Mach 30 and temperatures near 9,726°C to study electromagnetic interactions in ionized flows.

(2) Flight test infrastructure. The Mohave Aerospaceport planned a hypersonic flight corridor to the Pacific test range to provide an operational corridor for hypersonic testing. The House Armed Services Committee requested the DoD study at least two additional hypersonic test corridors in the FY2024 National Defense Authorization Act[23].

Multiple flight test platforms were advanced. Stratolaunch tested the Talon-A platform in several captive-carry flights, culminating in powered captive-carry trials of Talon-A1 in December[24]. Stratolaunch plans free-flight tests to validate separation, engine ignition, and hypersonic flight, with follow-on versions to validate autonomous landing and recovery. Stratolaunch won a Navy contract to support five hypersonic flight tests using Talon-A to carry the Modular Advanced Capability Hypersonic Testbed (MACH-TB), which is designed with modular payload bays to test multiple technologies per flight[25].

Under HyCAT, DIU awarded Fenix Space a contract to develop a reusable tow-launch system described as an “airborne launch pad” that can be towed by a regional jet and operate from existing airports to reduce weather delays[26]. DIU also funded Australia’s Hypersonix to develop the DART AE demonstrator, a hydrogen-fueled scramjet vehicle using additive manufacturing expected to fly at Mach 5–7 and support hypersonic flight trials[27]. DIU planned to pair DART AE with the HyCAT launch system for tests within 12–18 months.

To handle large data volumes from hypersonic tests, in August the DoD Test Resource Management Center planned a hypersonic missile flight test data processing center at Hector Airport in Fargo, North Dakota, to manage telemetry from the SkyRange unmanned system and help researchers access and analyze test data[28].

The U.S. also expanded rapid and affordable launch options. Rocket Lab introduced the HASTE suborbital rocket for hypersonic and suborbital testing with payload capacities up to 700 kg, enabling more frequent and lower-cost test launches[29]. Rocket Lab has been used to launch the MACH-TB and will support DIU deployments of DART AE.

1.7 Strengthening Industrial Capacity and Manufacturing

In 2023 the U.S. improved industrial capacity through top-level coordination, facility investments, advanced manufacturing, and supply chain resilience.

Top-level direction included a presidential policy supporting advanced manufacturing for air-breathing engines, advanced avionics, and navigation, positioning, and timing systems. Facility investments included a $216 million award to Aerojet Rocketdyne for expansion and modernization of solid rocket motor facilities and the opening of Northrop Grumman’s hypersonic capability center to integrate digital engineering into engine manufacturing and support low-cost, scaled production[30].

Digital manufacturing and automation were advanced via partnerships to deploy robotic systems for hypersonic missile production, reducing costs and risk[31]. The Navy Office of Naval Research funded the University of Arizona to use 3D printing for high-temperature hypersonic missile components. The DoD awarded contracts totaling $25 million to vendors including Northrop Grumman, GE, and C-CAT to expand production capacity for ultra-high-temperature composite materials and related equipment[32]. X-Bow was selected as a solid rocket motor supplier for Army and Navy boost-glide missiles to diversify sources and reduce costs.

1.8 Foundational and Applied Research

The DoD, services, NASA, industry, and universities made multiple advances in propulsion, materials, structures, guidance, and thermal management in 2023. Examples include NASA testing a rotating detonation rocket engine, DoD awards for 3D-printed engines, and prototype turbine-based combined-cycle and scramjet tests at Purdue. Startups received funding for plasma-assisted combustion, rotating detonation engines, and variable-geometry hypersonic concepts; the Navy funded adaptive scramjet concepts; and GE demonstrated a dual-mode scramjet concept using rotating detonation combustion[33–37].

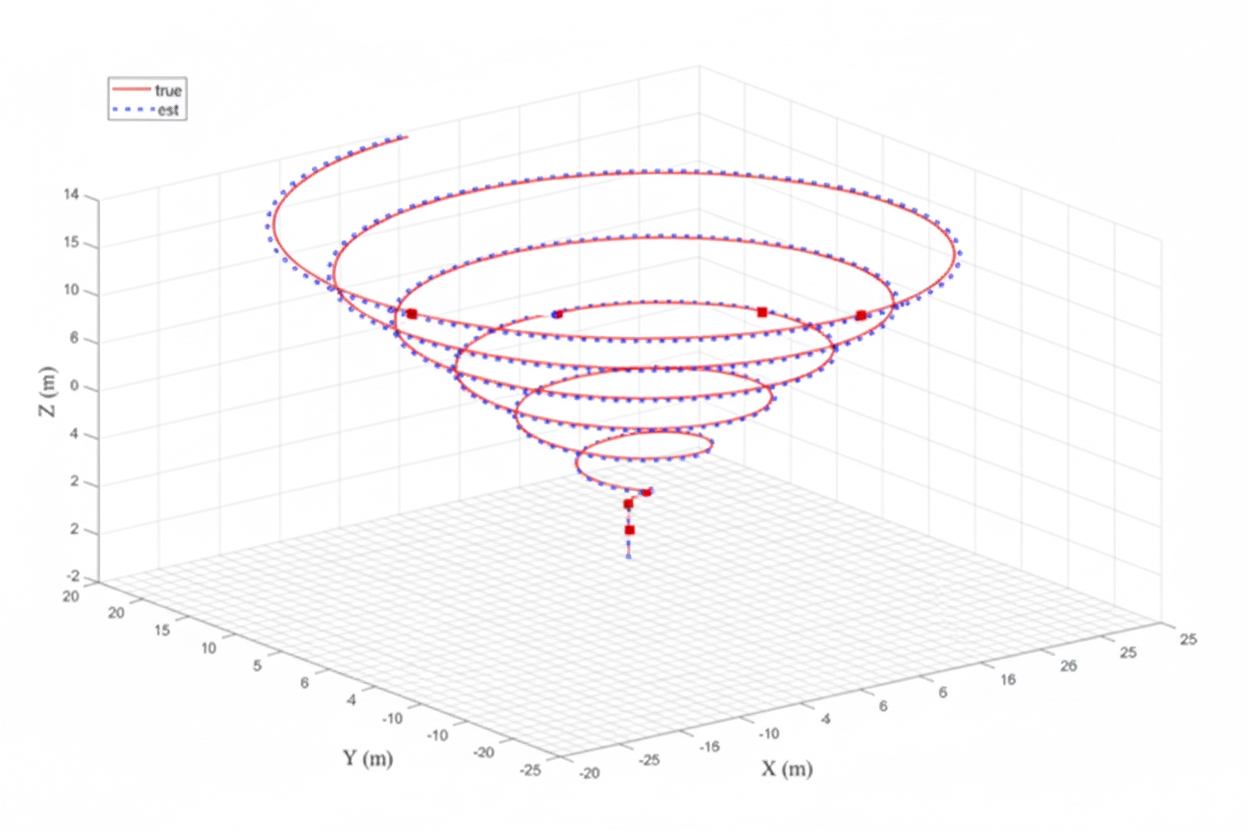

Materials and thermal protection work included a Navy-led Jahvaa effort to develop carbon-carbon alternatives to reduce cost for thermal protection systems, and projects studying ceramic matrix composites and high-temperature metals[38]. Structure testing advanced at AEDC for wedge-shaped test articles to study structural deformation and heating effects at hypersonic conditions[39]. Navigation and PNT work included Navy solicitations for PNT alternatives, exploring optical terrain matching and machine learning to correct inertial navigation drift[40]. DARPA funded a “sweating” cooling technique demonstration to transport coolant through artificial pores to cool hypersonic surfaces[41]. The DoD also supported university research to quantify uncertainties in hypersonic modeling and reduce simulation error sources.

2. Russia: Zircon Deployment, Continued Use and Mass Production of Kinzhal

In 2023 Russia deployed the Zircon hypersonic missile and continued operational use of the Kinzhal, while seeking mass production to replenish stocks. Zircon, with reported speeds up to Mach 9 and ranges over 1,000 km, was deployed on the Admiral Gorshkov frigate and demonstrated in naval exercises[42]. Russia reported deploying Zircon on Yasen-class nuclear submarines and used Zircon-equipped ships in Atlantic exercises. Meanwhile, the Kinzhal ballistic missile was used multiple times in the Ukraine conflict, striking high-value targets. Russia increased Kinzhal production capacity and conducted MiG-31 and Su-34 launch operations to demonstrate deterrent capability[43–45].

3. Europe and Canada: Steady Progress on Hypersonic Missiles and Reusable Vehicles

3.1 United Kingdom

In July the UK Ministry of Defence created a department responsible for hypersonic technology development. The department aims to pursue advanced hypersonic strike capabilities under international cooperation frameworks, including joint procurement of boost-glide missiles, collaboration on existing hypersonic projects, and development of sovereign capabilities such as hypersonic cruise missiles. The UK plans a multi-supplier hypersonic technology and capability development framework valued up to GBP 1 billion over seven years[46].

3.2 France

In June France's procurement agency conducted the first flight test of the V-max hypersonic glide vehicle, collecting valuable data to inform subsequent tests. V-max is expected to be deployed on French surface combatants to strike time-sensitive maritime targets[47].

3.3 Switzerland

Switzerland continued development of hydrogen-fueled subsonic and hypersonic aircraft. In February Destinus received EUR 26.7 million from Spain to build a hydrogen-fueled engine test facility and support liquid hydrogen propulsion research. In May Destinus conducted its first flight of the subsonic Destinus-1 demonstrator, validating afterburner performance and additive manufacturing approaches. Destinus is developing larger prototypes and has stated a long-term objective of a large hydrogen-fueled hypersonic airliner[48–49].

3.4 Canada

Canada progressed the Hello spaceplane family. In June Canadian Space Engine Systems announced the 21.3 m Hello-1X technology demonstrator with a titanium/stainless-steel structure powered by a DASS GNX precooled turbine-based combined-cycle engine. Hello-1X was being integrated for subsonic flight tests planned before February 2024 and aims to support point-to-point transport, suborbital returns, and low-cost access to low Earth orbit[50].

4. Asia-Pacific Neighbors: Collaborative and Indigenous Hypersonic Development

4.1 Japan

Japan accelerated weaponization of hypersonic technologies in 2023. The Ministry of Defense awarded Mitsubishi Heavy Industries contracts to develop a hypersonic cruise missile and a boost-glide hypersonic missile, aiming for deployment within five years to enhance strike capabilities. The cruise missile was named the Supersonic Combustion Ramjet-driven Hypersonic Weapon (SHW), which uses a dual-mode scramjet and liquid hydrocarbon active cooling to fly faster than Mach 5[51]. Japan also began development of a high-speed glidebody-based land-launched boost-glide weapon and later plans for a wave-rider glidebody variant.

4.2 India

India conducted a third flight test of the Hypersonic Technology Demonstrator Vehicle (HSTDV) in January 2023; details were not disclosed[52]. Earlier tests included a 2020 flight during which the HSTDV reportedly flew at Mach 6 for 23 seconds after separation from its booster. India is also developing BrahMos-II hypersonic cruise missile capabilities and invested in test infrastructure, including a hypersonic wind tunnel capable of Mach 5–12 conditions to support control and extreme-temperature research.

4.3 Iran

In June Iran’s Revolutionary Guard displayed the Fattah hypersonic ballistic missile with a reported range of 1,400 km and speeds of Mach 13–15, using a two-stage solid rocket motor and movable auxiliary nozzles for maneuvering. Iran announced plans to install hypersonic missiles on the Damavand-2 destroyer, and in November unveiled an upgraded Fattah-2 with a hypersonic glide vehicle, claiming maneuverable speeds from Mach 5 to Mach 20[53].

5. Analysis

5.1 Global Diffusion and Strategic Impact

Hypersonic technology continued to diffuse globally in 2023, with an increasing number of countries acquiring relevant capabilities. Hypersonic missiles are the near-term priority for many states, and hypersonic aircraft programs are also advancing rapidly in the U.S. and Europe. The spread of hypersonic capabilities will have significant implications for global strategic dynamics.

5.2 Hypersonic Missiles as an Immediate Priority

Hypersonic missiles offer long range, high speed, strong penetration, and challenging intercept profiles. They boost deterrence and could produce disruptive strike effects on future battlefields. Two principal technical approaches are boost-glide and air-breathing cruise configurations. Russia’s operational use of hypersonic missiles has prompted accelerated weaponization efforts in the U.S. and Europe. The U.S. shifted emphasis toward hypersonic cruise missiles for cost and operational considerations, while boost-glide ground- and sea-based programs faced repeated test setbacks. Countries with relatively mature hypersonic programs continue to develop and deploy new variants. Based on current plans, multiple hypersonic missile types are expected to enter service worldwide before 2030.

5.3 Strong Momentum for Reusable Hypersonic Vehicles

Reusable hypersonic vehicles, including hypersonic aircraft and spaceplanes, attracted intense attention in the U.S. and Europe. Hypersonic aircraft capable of Mach 6+ promise rapid transport, combined reconnaissance-strike roles, and potential first-stage options for multi-stage launch systems. The U.S. advanced prototype ground tests and near-term flight trials, while startups and established firms accelerated development targeting operational capability in the 2030s. The UK, Switzerland, and Canada also advanced precooled and hydrogen-fueled propulsion approaches, with notable progress in test articles and demonstrators.

5.4 The United States as an Example of an Emerging Hypersonics Ecosystem

The U.S. is building an innovation ecosystem for hypersonic technology by coordinating organizations, sustaining high funding, modernizing manufacturing, enhancing test capabilities, and strengthening industrial bases. The July 2022 National Hypersonic Initiative 2.0 proposed four pillars: affordable capabilities, disruptive operational advantage, workforce development, and test and evaluation capacity. U.S. 2023 activities reflect these goals, aiming to restore leadership in hypersonic technology through broad foundational research and a robust acquisition environment to accelerate capability generation in a cost-conscious manner.

6. Conclusion

In 2023, many countries accelerated hypersonic technology development. Hypersonic missiles remained a near-term focus, and reusable hypersonic vehicle technology advanced rapidly. International activity shows a clear trend of investing in foundational research and strengthening test and industrial capabilities, supporting long-term development. These developments warrant continued attention.

DOI: 10.16358/j.issn.1009-1300.20240503