Introduction

In electronics design, where heat dissipation can make or break performance, metal core printed circuit boards (MCPCBs) stand out as essential solutions. These thermal PCBs, often featuring aluminum or copper bases, efficiently transfer heat away from high-power components like LEDs, power converters, and automotive modules. But while their benefits are clear—superior thermal conductivity up to 2.0 W/m·K compared to FR-4's 0.3 W/m·K—their pricing can surprise newcomers. As a consultant who's guided factories through countless MCPCB runs, I've seen how small choices in materials or processes ripple into big cost differences.

This breakdown explores MCPCB cost factors, from aluminum PCB price drivers to copper core PCB cost nuances and broader PCB manufacturing cost trends. Drawing on 2025 data, we'll unpack verifiable ranges—like $0.50 to $3.00 per square inch for standard aluminum designs—and share approachable strategies to keep thermal PCB pricing in check. Whether you're prototyping a lighting array or scaling production, understanding these elements ensures budgets align with reliability. Let's demystify the numbers.

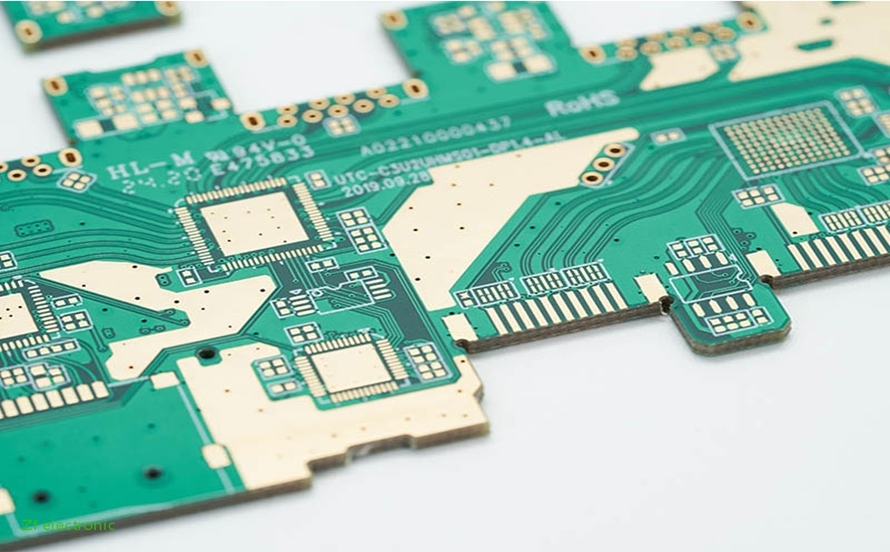

What are Metal Core PCBs and Why They Matter

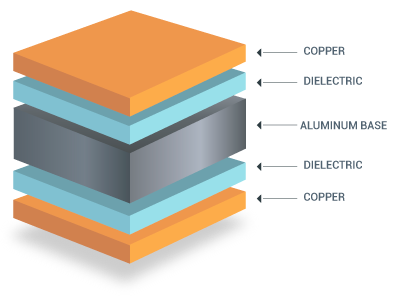

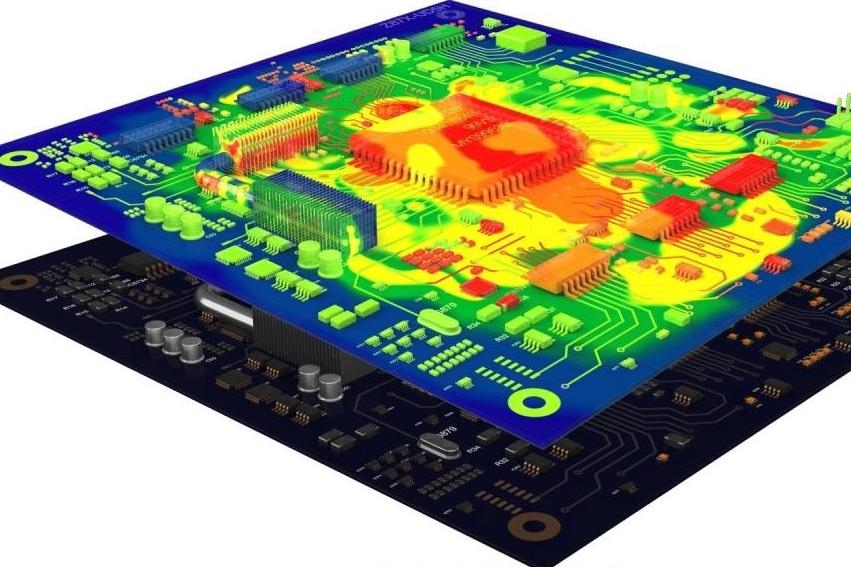

When deciding on the right substrate for a project, the comparison of Aluminum vs. FR4 PCB material is a critical starting point. Metal core PCBs replace traditional FR-4 substrates with a metallic base—typically aluminum or copper—sandwiched between a thermally conductive dielectric and copper traces. This setup excels in applications demanding rapid heat spreading, such as high-brightness LEDs or electric vehicle inverters, where standard boards might overheat and fail JEDEC JESD22 thermal cycling tests.

Aluminum PCBs dominate for cost-sensitive uses, offering good conductivity at lighter weights, while copper core variants suit ultra-high-power needs with thermal performance up to 400 W/m·K. Per IPC-4101C specifications for base materials, these boards must maintain dielectric strength (> 5 kV/mm) and low thermal resistance, ensuring compliance in demanding environments.

Why focus on costs now? In 2025, rising raw material prices have pushed MCPCB expenses up 20-30% from 2020 levels, driven by supply chain strains and demand for sustainable electronics. For procurement teams, grasping these MCPCB cost factors means avoiding surprises—think prototypes ballooning from $50 to $300 due to overlooked features—while factories balance quality under ISO 9001:2015 systems. In my advisory work, I've helped clients shave 15-25% off quotes by tweaking just a few variables.

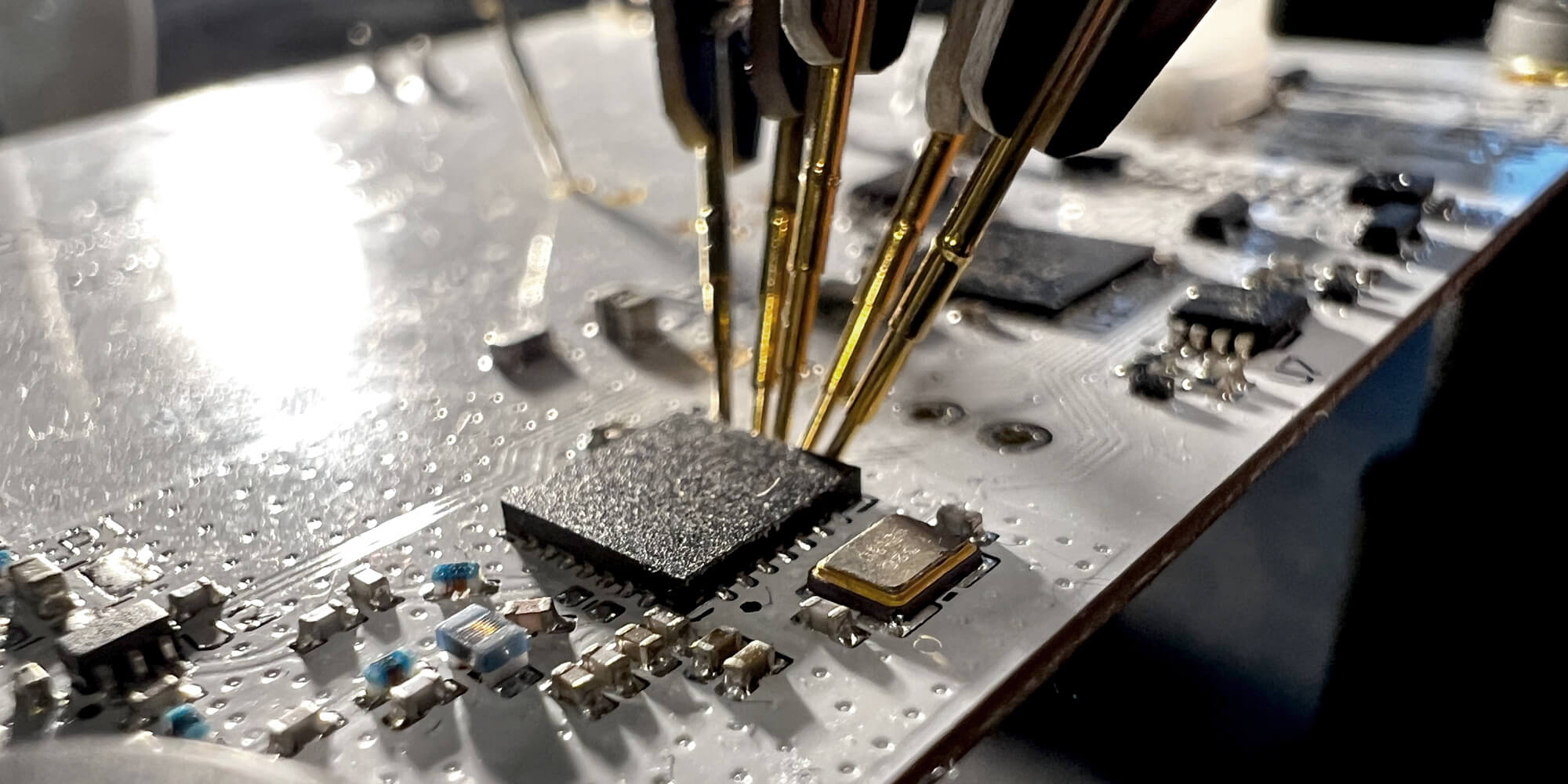

Key Cost Factors in MCPCB Manufacturing

MCPCB pricing isn't one-size-fits-all; it's a blend of materials, design, and production choices. Let's walk through the main drivers, grounded in real factory examples and 2025 benchmarks.

Material Selection: The Foundation of Thermal PCB Pricing

Materials account for 30-50% of total costs, with the metal base leading the charge. Aluminum substrates, per IPC-4101C, cost $0.20-$0.50 per square inch due to their availability, but copper cores spike to $0.80-$1.50 per square inch from higher raw metal prices and processing demands. The dielectric layer adds $0.10-$0.30, varying by thermal conductivity—standard 1.0 W/m·K is cheaper than high-end 2.2 W/m·K options, which tack on 15-20%.

In a recent factory audit, switching from copper to aluminum for a mid-power LED board dropped material costs by 40%, without sacrificing IPC-A-600 acceptability. Thicker copper foils (e.g., 2 oz vs. 1 oz) further inflate prices by 10-15%, essential for heavy-current traces but overkill for many designs.

Related Reading: PCB Material Selection: Balancing Thermal Performance and Cost

Design Complexity and Layer Count

Single-layer MCPCBs keep things simple and affordable—ideal for basic thermal routing—but adding layers for signal integrity pushes costs up 20-50% per layer due to lamination challenges. Vias or microvias, crucial for multilayer thermal paths, add $0.10-$0.50 per square inch, as they require precise drilling to avoid delamination under IPC-TM-650 thermal stress tests.

Board size and thickness play in too: A 5x5 inch prototype at 1.6mm might run $50-$100, but scaling to 10x10 inches or 2.0mm thickness adds 5-10% for handling and material use. Non-standard shapes demand extra CNC routing, hiking machining fees by $20-$50 per panel.

Production Volume and Turnaround Time

Volume is a game-changer in PCB manufacturing cost. Prototypes (1-10 units) hit $5 per square inch, but 1,000-unit runs drop to $1 per square inch through economies of scale. Low volumes suffer from full-panel processing, where small boards waste expensive metal—I've seen 30% utilization losses in early prototypes.

Rush orders? Expect a 20-50% premium for 3-5 day turns, as factories prioritize tooling over standard 7-14 day queues. Certifications like UL 94 for flammability add $100-$500 in non-recurring engineering (NRE) fees.

| Cost Factor | Impact on MCPCB Price | 2025 Example Range |

|---|---|---|

| Aluminum Base | 20-30% of total | $0.20-$0.50/sq in |

| Copper Core | 40-60% higher than aluminum | $0.80-$1.50/sq in |

| Layer Count | +20-50% per added layer | Single: $1.50-$2.50/sq in; Double: $2.00-$3.50 |

| Board Size/Thickness | +5-10% for larger/thicker | 10x10 in at 2mm: +$50-$100/board |

| Volume | Scales down with quantity | 10 units: $5/sq in; 1,000: $1/sq in |

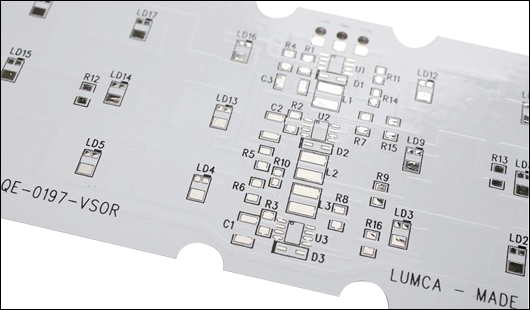

Aluminum PCB Price Breakdown: Everyday Thermal Solutions

Aluminum MCPCBs offer a sweet spot for aluminum PCB price, averaging $0.50-$3.00 per square inch in 2025, up from $1.20-$3.00 in 2020 due to metal volatility. For a 5x5 inch single-layer prototype with HASL finish, budget $50-$200, including $30-$100 setup. Surface finishes like ENIG add $0.20-$0.50 per square inch for better solderability, while silkscreen bumps it 5-8%.

In LED lighting runs I've consulted on, opting for 1.0mm aluminum thickness kept costs under $1.50 per square inch at volume, meeting IPC-6012 performance specs for rigid boards. Testing—electrical at $0.05-$0.10 per square inch or thermal at $1 per unit—ensures reliability but can double prototype tabs if over-specified.

For more aluminum PCBs thermal solutions, see our comprehensive guide: Aluminum PCBs: The Comprehensive Guide to Metal Core Circuit Boards

Copper Core PCB Cost Considerations: Premium Power Handling

Copper core PCB cost runs higher, often 1.5-2x aluminum due to raw material premiums and machining hurdles. Expect $1.50-$4.00 per square inch for prototypes, with heavy copper (up to 10 oz) pushing toward the upper end for power supplies.

Processing adds layers: Copper's density demands specialized lamination and etching, plus rigorous quality checks like X-ray for bonding integrity. In a 2025 automotive project I reviewed, full-process prototyping for 5 units hit $300+ per board, largely from low-volume panel waste and dielectric testing for > 5 kV strength.

Thermal PCB Pricing Trends in 2025

Thermal PCB pricing reflects broader shifts: Raw metals up 25% year-over-year, but automation has capped labor hikes at 10%. High-volume runs now dip below $1 per square inch for aluminum, thanks to panelization efficiencies, while copper holds at $2-$3 for specialized apps.

Sustainability pushes trends too—recycled aluminum cuts 10-15% off eco-focused quotes, aligning with ISO 14001. For 2025, expect stable pricing if supply chains hold, but design for modularity to hedge against fluctuations.

Practical Tips to Optimize MCPCB Costs

Factories thrive on smart tweaks. Here's how to trim without cutting corners:

- Simplify Design: Stick to single-layer where possible—saves 30-50% vs. multilayer. Balance copper pours for even thermal flow, reducing via needs.

- Standardize Specs: Use HASL finishes ($0.10-$0.30 cheaper than ENIG) and 1.6mm thickness unless heat demands more.

- Panelize Early: Group boards on shared panels to boost utilization by 20-30%, slashing waste.

- Volume Planning: Prototype small, but quote at 500+ units for 40% savings. Avoid rushes—standard turns save 20-50%.

- Material Matching: Aluminum for most thermal needs; reserve copper for > 200W dissipation to justify premiums.

In one case, a client's LED prototype went from $250 to $150 by panelizing and ditching microvias.

Case Study: Cost Savings in Automotive Power Module

A mid-tier supplier needed 200 aluminum MCPCBs for EV inverters—6x8 inch, double-layer, 1.5mm thick. Initial quotes hit $4 per square inch from copper base and ENIG finish. Analysis revealed over-spec: Switched to aluminum (1.5 W/m·K dielectric), HASL, and panelized layout per IPC-2221B design rules.

Result? $2.20 per square inch—45% savings—and passed JEDEC thermal quals. This mirrors 2025 trends, where hybrid FR-4/MCPCB stacks cut costs 20% for moderate heat apps.

Conclusion

Metal core PCBs deliver unmatched thermal prowess, but their pricing hinges on thoughtful choices in materials, design, and scale. From aluminum PCB price at $0.50-$3.00 per square inch to copper core PCB cost premiums, 2025's MCPCB cost factors reward proactive planning. By leaning on standards like IPC-4101C and tips like panelization, you can secure reliable boards without budget overruns.

In my factory consultations, these strategies consistently yield 15-30% efficiencies. For your next thermal project, audit early—it's the flat path to value.

FAQs

Q1: What are the main MCPCB cost factors influencing aluminum PCB price?

A1: The primary cost drivers are the dielectric layer's thermal conductivity and copper weight. Higher thermal performance significantly increases price, while the aluminum base thickness and specific alloy grade also directly impact material expenses.

Q2: How does copper core PCB cost compare to standard thermal PCB pricing?

A2: Copper core PCBs command a higher price than standard aluminum substrates. This premium reflects higher raw material costs and more complex manufacturing processes required for exceptional thermal conductivity in high-performance designs.

Q3: What impacts PCB manufacturing cost for low-volume MCPCB prototypes?

A3: Low-volume MCPCB prototype costs are driven by initial setup fees and NRE charges. Material selection, particularly high-performance dielectrics, significantly impacts pricing when fixed manufacturing costs aren't offset by mass production.

Q4: How have MCPCB cost factors trended from 2020 to 2025?

A4: From 2020 to 2025, MCPCB costs shifted from pandemic-driven supply volatility to stabilization. Advancing automation and increased demand for high-performance thermal materials have since refined pricing structures for global markets.

Q5: What tips lower aluminum PCB price without compromising performance?

A5: Optimize panel utilization and use standard material thicknesses to minimize waste. Avoid over-specifying thermal conductivity; selecting a grade that precisely meets your design requirements reduces costs without compromising performance.

References

JEDEC JESD22 — Reliability Qualification of ICs. JEDEC Solid State Technology Association, latest edition.

IPC-4101C — Specification for Base Materials for Rigid and Multilayer Printed Boards. IPC – Association Connecting Electronics Industries, 2006.

ISO 9001:2015 — Quality Management Systems – Requirements. International Organization for Standardization, 2015.

IPC-A-600H — Acceptability of Printed Boards. IPC, 2014.

IPC-TM-650 — Test Methods Manual. IPC, latest edition.

UL 94 — Standard for Safety of Flammable Materials. Underwriters Laboratories, latest edition.