Introduction

Over the past decade RF front-end solutions have advanced rapidly. Modularization has been a major direction in this evolution. This article reviews the development of RF front-end modules, explains what modularization entails, and discusses the challenges and likely future trends for RF front-end product modularization.

What is RF front-end modularization?

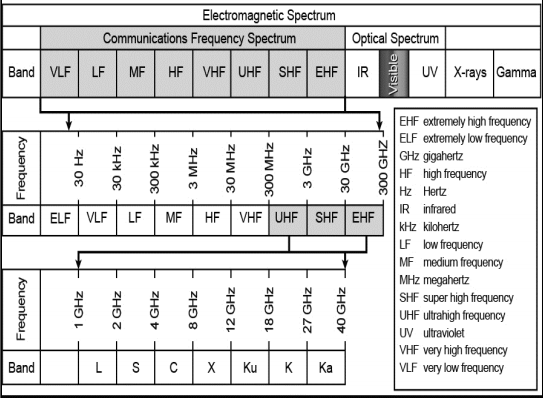

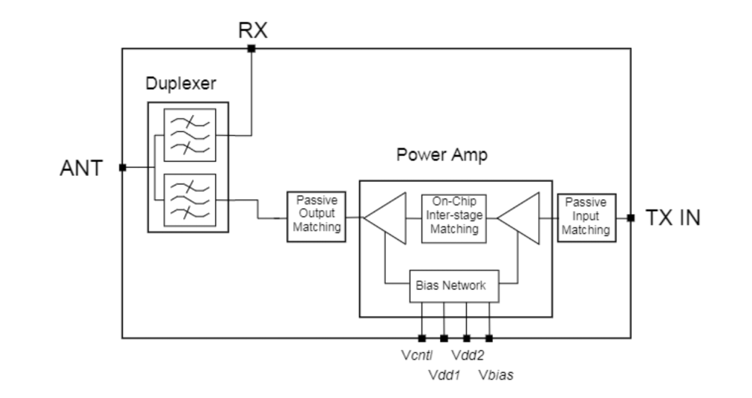

RF front-end refers to the circuitry between the antenna and the transceiver. Typical RF front-end components include power amplifiers (PA), switches, low-noise amplifiers (LNA) and filters (duplexers or filters).

Modularized RF front-end solutions (integrated solutions) are the counterpart to discrete solutions. On the transmit path, modularization typically integrates the PA, switch and filter (or duplexer) to form PAMiD-type modules. On the receive path, modularization integrates the receive LNA, switch and receive filter to form L-FEM-type modules.

During the early 3G and 4G eras, phones required support for relatively few bands, so RF front ends were typically discrete. As 4G evolved into a multi-band, multi-mode era, the number of required components increased to support global bands, and RF front ends became more complex. Discrete solutions increasingly struggled to meet demands for higher integration and performance, which accelerated adoption of modular solutions. For example, iPhone models now use modularized front ends, and by 2020–2021 a number of mainstream smartphone models in the mid-price segment had adopted modular solutions.

Early history of 5G RF front-end modules

2000–2009: Pioneering efforts and the PAMiD emergence

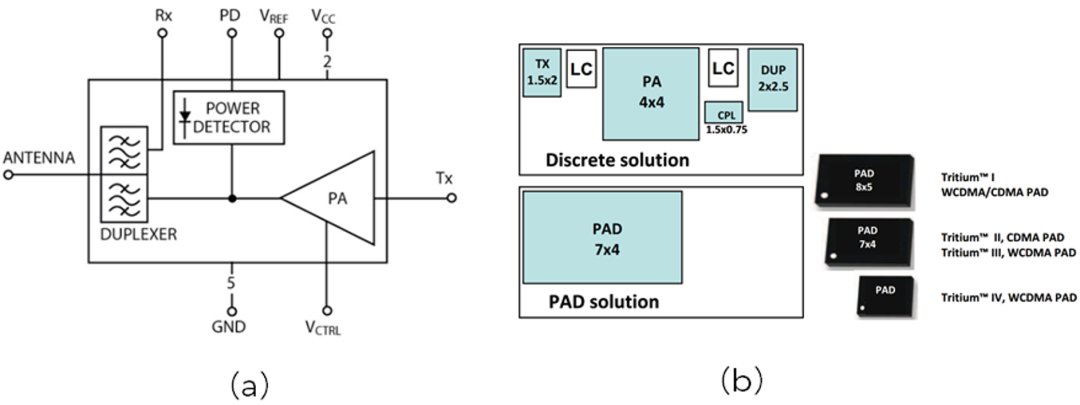

The most representative modular solution on the transmit side is the PAMiD module, which stands for PA Module integrated with Duplexer and was earlier referred to as PAD. PAMiD integrates the PA, switch and filter into one module.

Early PAMiD work can be traced to the early 2000s. Two pioneering RF front-end vendors, Triquint and Agilent, recognized the integration benefits and began early modular development. Triquint, after acquiring filter supplier Sawtek, started development of the TQM71312 module around 2001. A 2003 report in Microwave Journal described this product and noted that modular design could deliver higher performance, higher integration, smaller size and easier use, with an average current reduction of 40%.

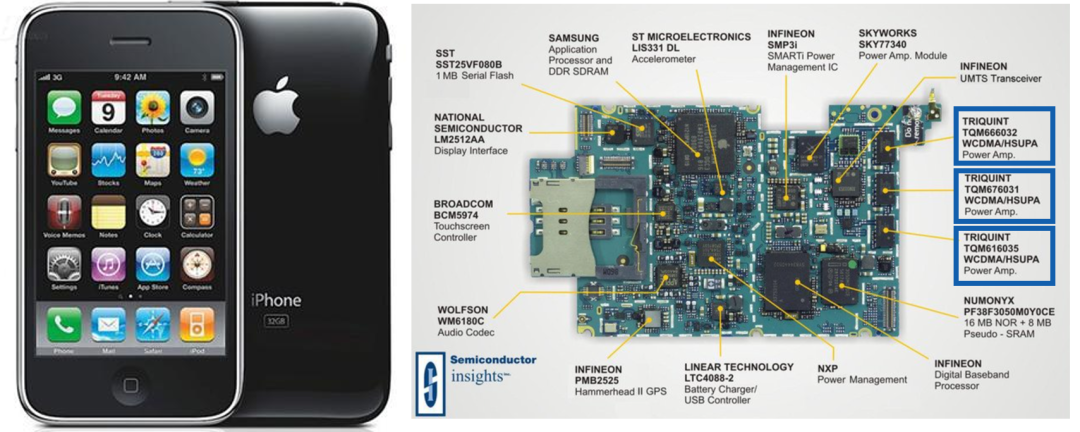

Triquint's Tritium series modules were later used in the 2008 iPhone 3G as part of the 3G RF front end. Triquint subsequently merged with RFMD to form Qorvo, and the modular integration experience continued under the new company.

Agilent also pursued modular integration. Agilent began FBAR filter production in 2001 and achieved high-volume shipments by 2002, making integration of its PA and filter products a natural step. The AFEM-7731 CDMA PAD product launched in 2005 integrated a CDMA PA and a duplexer; the low insertion loss of FBAR filters supported favorable linearity and efficiency.

Agilent’s RF front-end business later spun out as Avago, which went public in 2009 and later merged to become Broadcom. Around 2010, improvements in PA architectures and processes enabled stronger PA performance, which helped drive successful integrated module products. From 2012 onward, Avago/Broadcom RF front-end modules were widely used in iPhone models.

2010–2019: Industry consolidation and modularization becoming mainstream

Apple played a leading role in pushing modular RF front ends into mainstream smartphone designs. The iPhone 4 (2010) and iPhone 5 (2012) used modularized PAMiD solutions from suppliers such as Triquint, Avago and Skyworks. In parallel, RF front-end vendors consolidated to better support integrated module strategies:

- 2014: RFMD merged with Triquint to form Qorvo.

- 2014–2016: Skyworks formed and consolidated joint ventures with other suppliers.

- 2017–2019: Qualcomm and TDK established RF360 as a joint initiative and later consolidated it under Qualcomm.

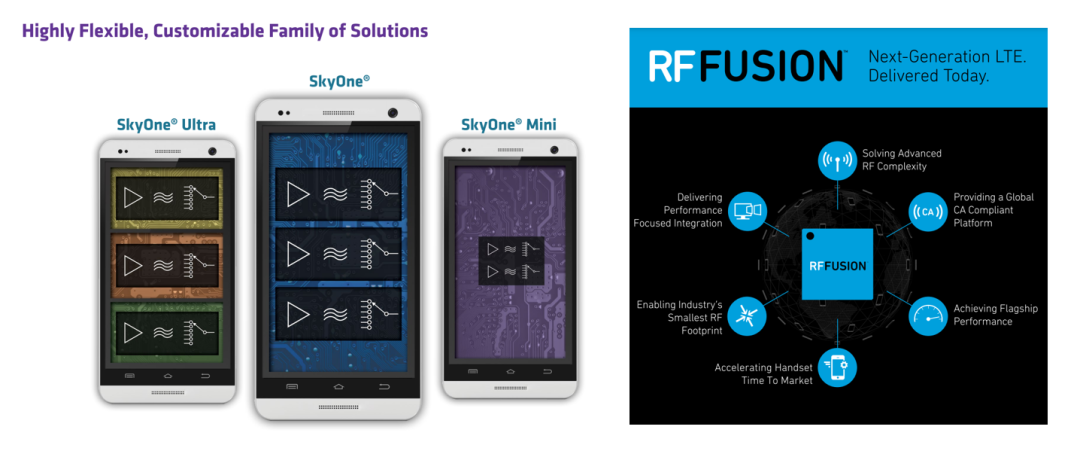

Vendors also offered modular products to the open market. Skyworks introduced SkyOne and Qorvo introduced RF Fusion in 2014, both aiming to integrate multi-band PAs, multi-throw switches and associated filters, duplexers and control functions into a highly integrated package.

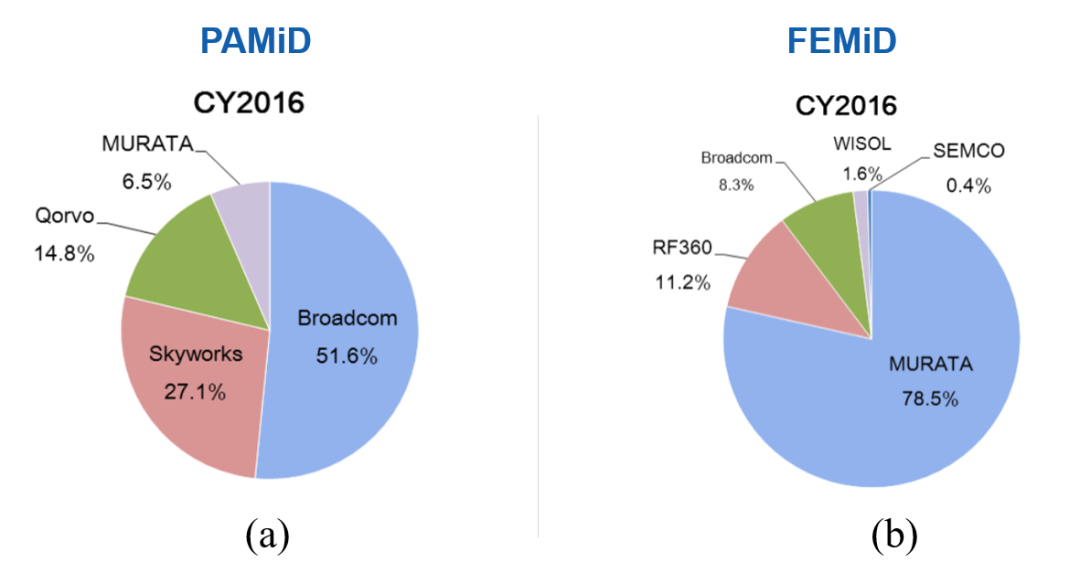

FEMiD emerged as an alternative modular approach. PAMiD requires a vendor to have both active-device expertise (PA, LNA, switches) and passive/filter capabilities (SAW/BAW/FBAR). Only a few vendors possess that full set of capabilities. FEMiD integrates antenna switches and filters into a module provided by filter vendors, while keeping the PA as a discrete component supplied separately. This approach leverages the strengths of passive and active suppliers and reduces dependence on PAMiD-capable vendors.

By 2016, major PAMiD suppliers included Broadcom, Skyworks and Qorvo, while Murata and RF360 were among the main FEMiD suppliers.

5G era: current state

Phase6/7 series: standardization of PAMiD

Early public-market adoption of modular solutions was hindered by incompatible vendor-specific definitions. To address this, platform vendors, major smartphone OEMs and RF front-end suppliers collaborated to define Phase6 series RF front-end integration specifications. In Phase6, low-band (including 2G) and mid/high-band functions are implemented by two PAMiD modules to form a complete transmit solution.

Because Phase6 definitions were agreed by platform, OEM and chip vendors, Phase6 products gained acceptance among major smartphone manufacturers and became widely used in high-end phones. With 5G, Phase6 evolved into Phase7/7L while retaining PAMiD definitions.

Since 2020: domestic progress and competition

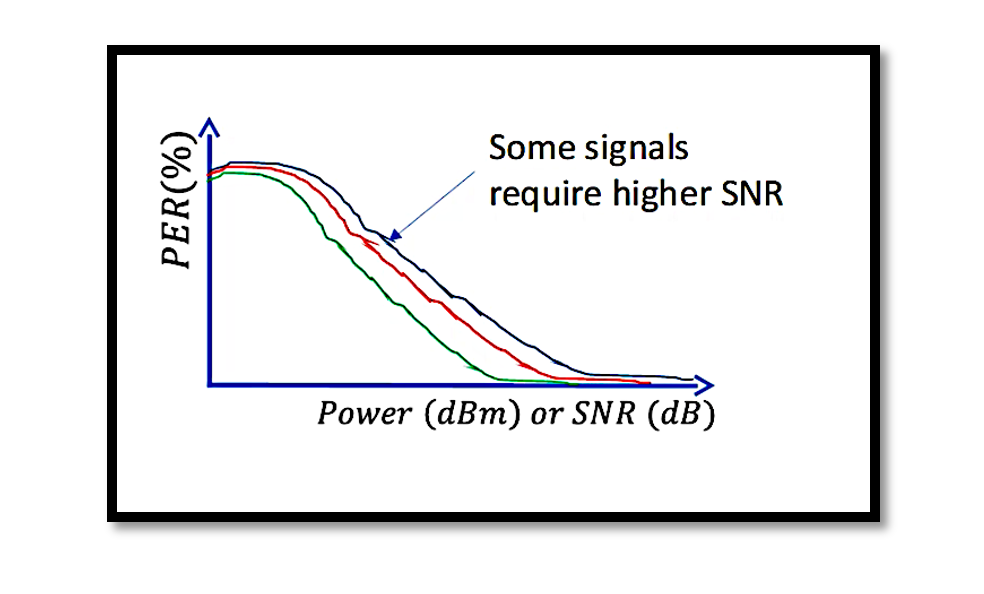

With commercial 5G deployments accelerating around late 2019, phones needed to support many more bands. 5G also defined ultra-high-band (UHB) sub-6 GHz frequencies (above 3 GHz, below 6 GHz) that impose higher performance demands on RF front ends.

After iteration, 5G solutions have converged into two main approaches: Phase7 series and Phase5N. Both adopt an L-PAMiF integrated module for the sub-6 GHz UHB portion. For the sub-3 GHz portion, Phase7 uses PAMiD modules while Phase5N uses discrete implementations.

Sub-6 GHz UHB: L-PAMiF commercial maturity

Sub-6 GHz UHB is a newly added 5G band with higher frequency and power and additional functions such as SRS switching. L-PAMiF, which integrates LNA, PA, filters, transmit/receive switches and SRS switches, has become the mainstream choice for these bands.

China-based vendors have gradually achieved breakthroughs in UHB L-PAMiF products. For example, in December 2019, two months after commercial 5G services launched in China, a domestic vendor began mass production of an n77/78/79 dual-band L-PAMiF module. This product was adopted by major smartphone OEMs in 2020 and 2021.

Other domestic RF front-end vendors launched UHB L-PAMiF products in 2021, and competition in this product category is expected to intensify.

Sub-3 GHz: remaining challenges for domestic vendors

Compared with Sub-6 GHz, Sub-3 GHz bands operate at lower frequency and lower power and do not require complex SRS switches, but they include many bands that require numerous filters and duplexers. These often use acoustic filters such as SAW, BAW and FBAR. Access to compact filters and the ability to design multi-band systems are key requirements.

Key challenges for Sub-3 GHz PAMiD/L-PAMiD module design include:

- Full-module circuit design and manufacturing capability

Vendors need mature design and productization for each sub-circuit within a module, such as PAs, LNAs and switches for each band, and there must be no weak submodule in performance. - Strong system-level design capability

Fully integrated modules form complex systems that require solving transmit/receive isolation, inter-band suppression and carrier aggregation routing, among other issues. RF front-end vendors must have strong system analysis and design skills. - Compact filter resources

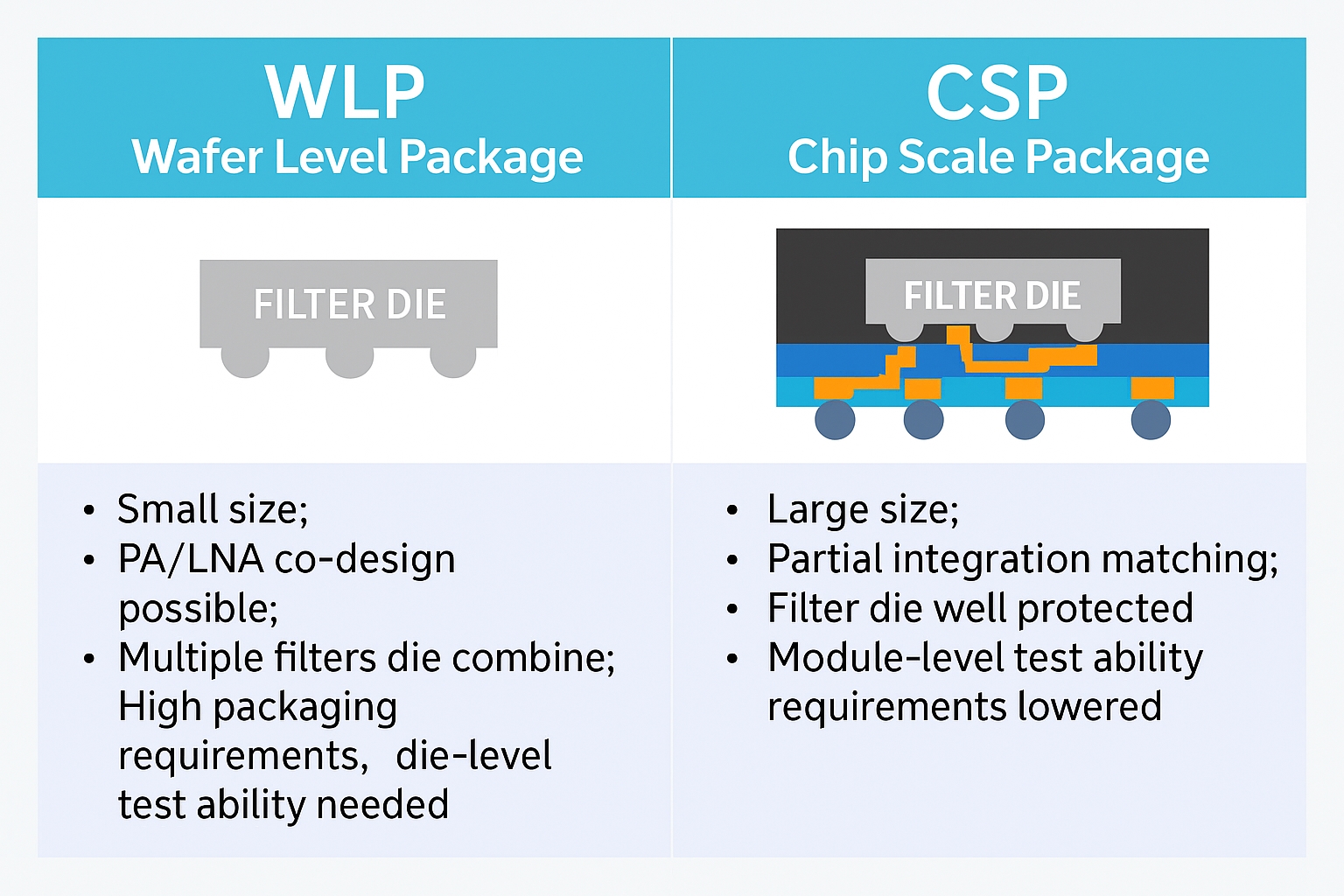

Small, module-integrable filters are scarce. The main filter package types used for Sub-3 GHz are wafer-level package (WLP) and chip-scale package (CSP). WLP filters are smaller and have design advantages for integration, and they are the likely direction for module-integrated filters.

Until domestic vendors fully overcome these challenges, they often provide discrete solutions for Sub-3 GHz. The typical comparison between integrated and discrete Sub-3 GHz solutions is shown below.

Despite these challenges, modular RF front ends remain a necessary product category for China-based RF front-end vendors to master. Some domestic vendors have made early investments and achieved product series progress. For example, certain vendors use reconfigurable PA/LNA modules with software-tuning features that aid post-integration adaptation, and they have developed packaging control capabilities validated across multiple product generations. These advantages support multi-band module offerings for IoT and smartphone segments, including compact PAMiD and L-PAMiF modules compatible with Phase6/7 definitions.

Conclusion

Modularization is a major trend in RF front-end evolution. The shift places substantial technical demands on both filter suppliers and module integrators. Key challenges include access to compact filter technology, full-suite active and passive design capabilities, and strong system-level engineering to address multi-band operation and carrier aggregation requirements. Progress in these areas will determine the next stage of RF front-end module adoption.