Charging remains the core pain point; fast charging presents an opportunity

Demand for new energy vehicles has grown rapidly. Supported by a range of national policies, automakers have accelerated development of new-energy lines, launching higher-quality models, improving range, enhancing driver assistance, and expanding supporting infrastructure. In 2022, sales of new energy vehicles reached 6.887 million units; by the first half of 2023, the installed base of new energy vehicles reached 16.20 million units, an increase of nearly 53% year on year.

Battery electric vehicles account for the majority of new energy vehicle sales. In the first half of 2023, new energy vehicle sales were 3.747 million units, up 44.1% year on year. Battery electric vehicles accounted for 2.719 million units, or 72.56% of that total, while plug-in hybrid sales were 1.025 million units, or 27.36%.

Range anxiety remains a major barrier to wider electric vehicle adoption. Increasing battery energy density and shortening charging time are the two main ways to address range anxiety. Many current models already exceed 500 km of range, and range continues to improve as battery technology advances. At the same time, charging time is another urgent issue: consumers want higher charging power and faster charge speeds. A user survey by the China Automotive Center found that charging difficulty is a primary concern affecting EV purchase decisions.

High-voltage fast-charging architectures are becoming mainstream. For battery-electric vehicle owners, achieving refueling-like charging speed is a long-standing goal. Charging speed increases with charging power, and charging power equals voltage times current (P = U * I). Thus, charging efficiency can be improved by increasing either current or voltage. High-current approaches produce higher losses, increase cooling requirements, and complicate vehicle wiring, reducing their attractiveness. By contrast, high-voltage approaches avoid many losses, thermal and wiring issues associated with high current and are relatively easy to implement by increasing the number of series-connected battery cells. Therefore, high-voltage solutions are expected to become the dominant approach.

What is an 800V high-voltage platform?

Claims such as "5 minutes charging for 200 km" or "12 minutes charging for 500 km" have highlighted the 800V high-voltage platform in reporting. The term "800V" is broad: it does not mean the vehicle electrical system is constantly at exactly 800 V. Instead, it is an average designation. A vehicle with a system voltage range roughly between 550 V and 950 V can be described as an 800V platform. Most current new energy vehicles use a 400V platform, with vehicle electrical system voltages typically in the 230 V to 450 V range.

At the same current, an 800V vehicle can achieve higher charging power due to the higher voltage. For example, at 500 A, a 400V platform yields about 200 kW of charging power, while an 800V platform yields about 400 kW.

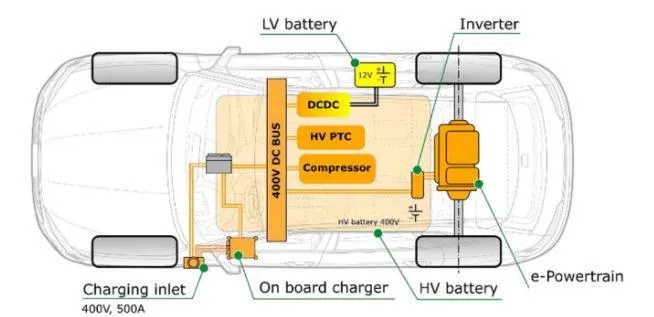

400V electrical topology

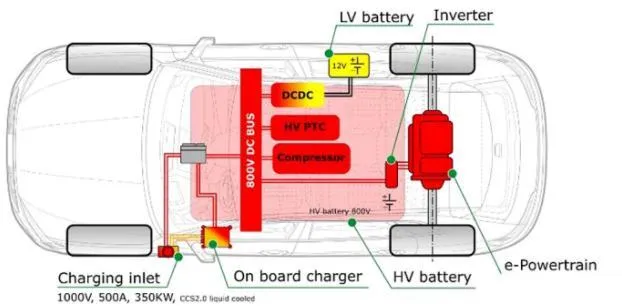

800V electrical topology

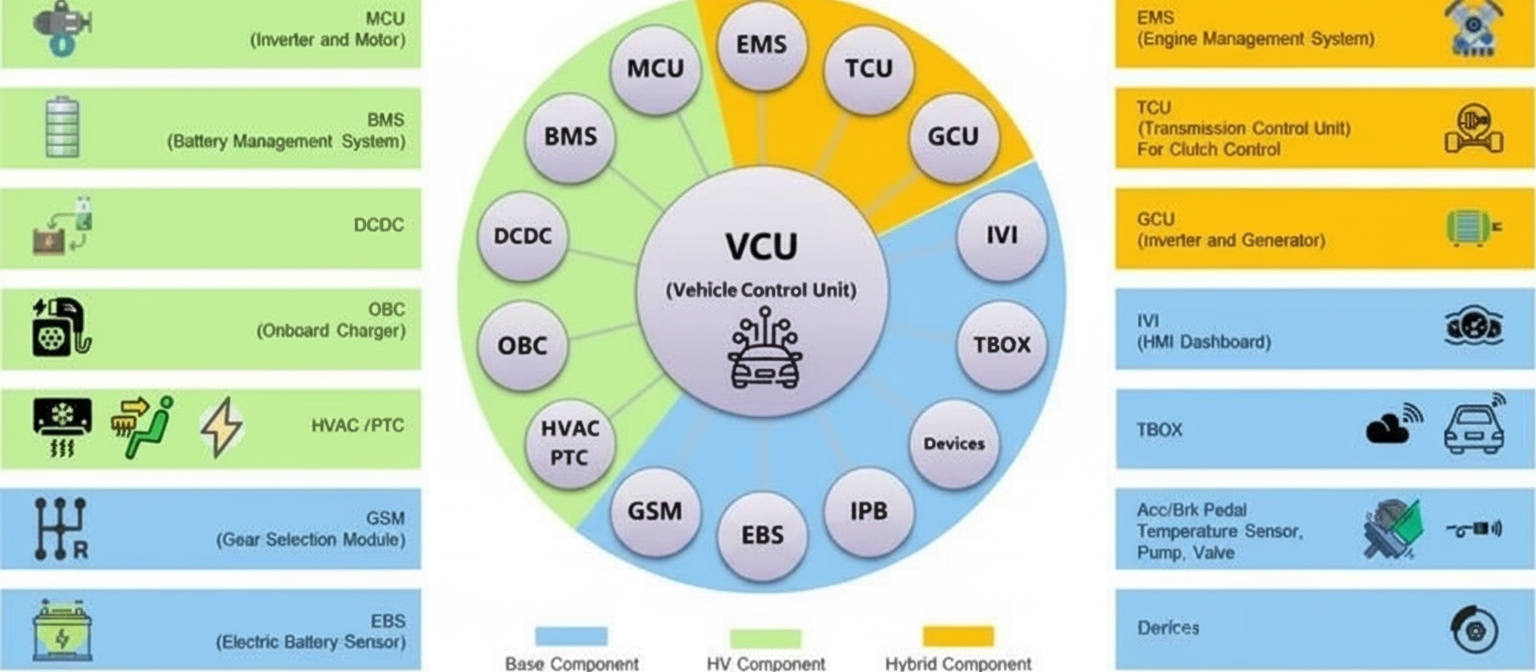

At first glance, the 400V and 800V topologies are similar; however, upgrading to an 800V architecture is a complex system-level task. Most existing DC fast-charging infrastructure is designed for 400V vehicles. Building an 800V ecosystem therefore requires both in-vehicle component upgrades and corresponding external charging infrastructure. On the vehicle side, required upgrades include the core "three-electric" systems, the air-conditioning compressor, DC/DC converters, the on-board charger (OBC), and other components. Externally, compatible high-power charging stations and charging poles are needed.

Advantages of high-voltage versus high-current schemes

- High-voltage architectures avoid the losses, thermal challenges, and wiring issues inherent to high-current solutions. Huawei research indicates low-voltage, high-current charging can only sustain maximum power in a narrow SOC window (about 10% to 20% SOC), with charging power dropping rapidly outside that window.

- High-voltage solutions are easier to implement by rearranging battery cell series/parallel configuration.

- Future eDrive Technologies estimates that under an 800V platform a 100 kWh battery pack could be lighter by about 25 kg.

- Larger current requires larger conductor cross-sections, complicating vehicle wiring; higher system voltage reduces wiring impact.

Electrical component upgrades

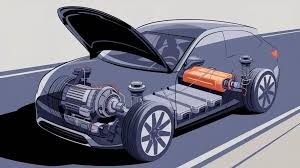

Under the 800V fast-charging trend, vehicle-side components and electronic parts need upgrading. Typical EV core components include the battery, motor, and power electronics. The small "three-electronics" include OBC, PDU, and DC/DC converters, plus electric compressors. Moving to 800V raises requirements for battery materials and increases demands on component voltage withstand and thermal performance. Key impacts on components include:

- Motor: move toward flat wire designs and liquid cooling; higher corrosion resistance and insulation requirements.

- Electric drive and control: SiC devices show significant advantages at 800V and are being adopted to replace silicon alternatives.

- Relays: higher-performance high-voltage relays are required, increasing overall value.

- Film capacitors: higher voltage ratings are needed.

- Wiring harnesses: more connectors and lower cable gauge ratings.

- Fuses: increased demand and faster penetration of new fuse types.

High-voltage fast charging raises component and subsystem requirements across the vehicle.

Automakers accelerating 800V platform deployments

As new energy vehicle penetration rises, legacy automakers are accelerating electrification and new entrants are growing production. Competition has deepened and diversified, and shortening charging time is a key way to improve EV user experience. The fast-charging and high-efficiency advantages of high-voltage architectures enhance model competitiveness and serve as a differentiator. Leading automakers have begun applying 800V platforms in higher-end models, and many manufacturers have announced or plan 800V vehicles.

China: Major Chinese automakers are accelerating deployment of high-voltage fast-charging models. Several manufacturers, including BYD, GAC Aion, BAIC Arcfox, Geely Zeekr, Dongfeng Voyah, Changan, Great Wall, and XPeng, have launched or planned high-end models based on 800V platforms, with fast-charging performance often enabling more than 200 km of range added in about 10 minutes of charging. Other manufacturers such as Li Auto, NIO, and Leapmotor have also announced 800V platform architectures or plans.

International: Leading global automakers were early adopters of high-voltage fast-charging models. In 2019 Porsche launched the Taycan with an 800V platform and an initial peak charging power of 270 kW, reaching 5% to 80% SOC in about 23 minutes; later versions reached up to 350 kW. Hyundai's E-GMP platform debuted in 2020. Audi introduced its PPE platform in 2021. Mercedes-Benz planned 800V models on the EVA platform, and Volkswagen targeted 800V production models around 2024. Other platforms such as GM's third-generation EV platform and Jaguar Land Rover's electrification platforms also chose 800V system voltages.

As 800V vehicles move into production, major automakers and charging operators are accelerating deployment of high-voltage, high-power DC charging networks to support the new vehicle platforms. Early on, many OEMs built their own fast-charging networks: XPeng began building an 800V/480 kW supercharging network in the second half of 2022; NIO launched a 500 kW ultrafast charger in December 2022; Li Auto planned a 400 kW super-fast charging rollout with a target of more than 3,000 stations nationwide by 2025; GAC Aion planned 2,000 supercharging stations across 300 cities by 2025. OEMs including Geely and BAIC have also built supercharging stations. Charging operators have accelerated construction of super-fast charging stations as well.

Battery makers advancing fast-charging technology

The traction battery is a critical element of the high-voltage platform architecture. Fast-charging battery technology is a key competitive factor for battery suppliers. Leading battery manufacturers in China are developing solutions to increase charge and discharge rates from about 1–2C toward 4C. Companies such as CATL, CALB, SVOLT, and EVE Energy have introduced fast-charging battery solutions that focus on battery materials, cell and pack structures, and battery pack thermal management innovation.