Overview

As vehicles electrify and become more intelligent, the in-car cockpit is gaining importance. Automakers worldwide are investing in cockpit systems to differentiate user experience. Traditional MCU chips are increasingly unable to meet the rapidly rising compute demands of modern cockpits, and cockpit compute chips are evolving from simple MCUs to highly integrated, higher-performance SoCs.

Market Context: Stagnant Vehicle Sales and Cost Pressure

Global and China vehicle sales have stagnated. According to data from the China Association of Automobile Manufacturers and the International Organization of Motor Vehicle Manufacturers, global vehicle sales have trended down since 2018. In 2022 global vehicle sales were 81.628 million units, down 1.4% year on year; China vehicle sales were 26.864 million units, up 2.1% year on year, still below 2018 levels.

With the market in a replacement and saturation stage, automakers are focusing on cost reduction and efficiency. Price competition increased in 2023, with some mass-market models seeing significant price cuts.

Growing Demand for Intelligent Cockpits

Replacement and upgrade cycles are expected to lift upgrade-driven purchases. Data from the National Information Center indicates replacement and upgrade purchases could account for 64% of sales by 2025 and 78% by 2030, driving greater emphasis on technology and in-car intelligence as purchasing factors.

The proportion of younger buyers is rising. The National Information Center projects buyers born in the 1990s and 2000s will account for 38% of purchases by 2025 and over 52% by 2030. These buyers, raised in the mobile internet era, demand personalised, visually appealing, and interactive cockpit experiences.

Smart Cockpit as a Key Purchase Consideration

With vehicle powertrains converging, cockpit experience has become a major differentiator for consumers. Showrooms increasingly prioritize the in-cabin experience, making cockpit intelligence a significant factor in purchase decisions. Expectations have shifted from basic safety and comfort toward emotional and experiential aspects, from efficient travel to enjoyable travel.

The intelligent cockpit integrates interior design and electronic systems to create human-machine interaction (HMI) systems. Cockpits are evolving from mechanical instrument panels plus simple entertainment systems toward intelligent, mobile-like cockpits.

As the cockpit becomes a "third living space," some consumer electronics scenarios may migrate from smartphones to in-vehicle systems. With improved interior intelligence, richer software and services, and unique in-car use cases, certain mobile app usage could shift to the vehicle. Current cockpit electronics include central displays, instrument clusters, smart speakers, infotainment systems, HUDs, DMS/OMS, streaming rearview mirrors, voice recognition, and gesture recognition.

In-Cabin Sensing: Rising Multimodal Requirements

In-cabin perception supports entertainment and autonomous driving features, enables personalized experiences, and improves decision accuracy. Interaction methods are expanding beyond buttons and touch to voice, gesture, fingerprint, sound-source localization, face recognition, and holographic displays.

Microphones: With growing voice interaction demand and advantages of microphone arrays for source localization, noise reduction, and echo cancellation, the number and penetration of in-cabin microphones are expected to grow. IHS forecasts multi-microphone array penetration in cabins will reach 89.8% by 2030, with an average of 8.7 microphones per vehicle.

Cameras: Demand for driver monitoring systems (DMS) and occupant monitoring systems (OMS) will increase camera penetration and counts. Forecasts suggest in-cabin camera penetration could reach 60% by 2030.

Cockpit Displays: Multi-Screen, Larger, and Higher-Resolution

Multi-screen: Central displays and LCD instrument clusters now appear across most price segments and represent the largest display market. Forecasts indicate strong growth for HUDs, side-view displays, and interior mirrors over the coming years.

High-resolution large screens: Ultra-large screens have seen rapid shipment growth since 2022. By 2030, shipments of ultra-large screens could reach several million units, with many 12-inch-plus screens moving from 800x480 toward 1280x720, and some upgrading to 1920x1080 or 4K.

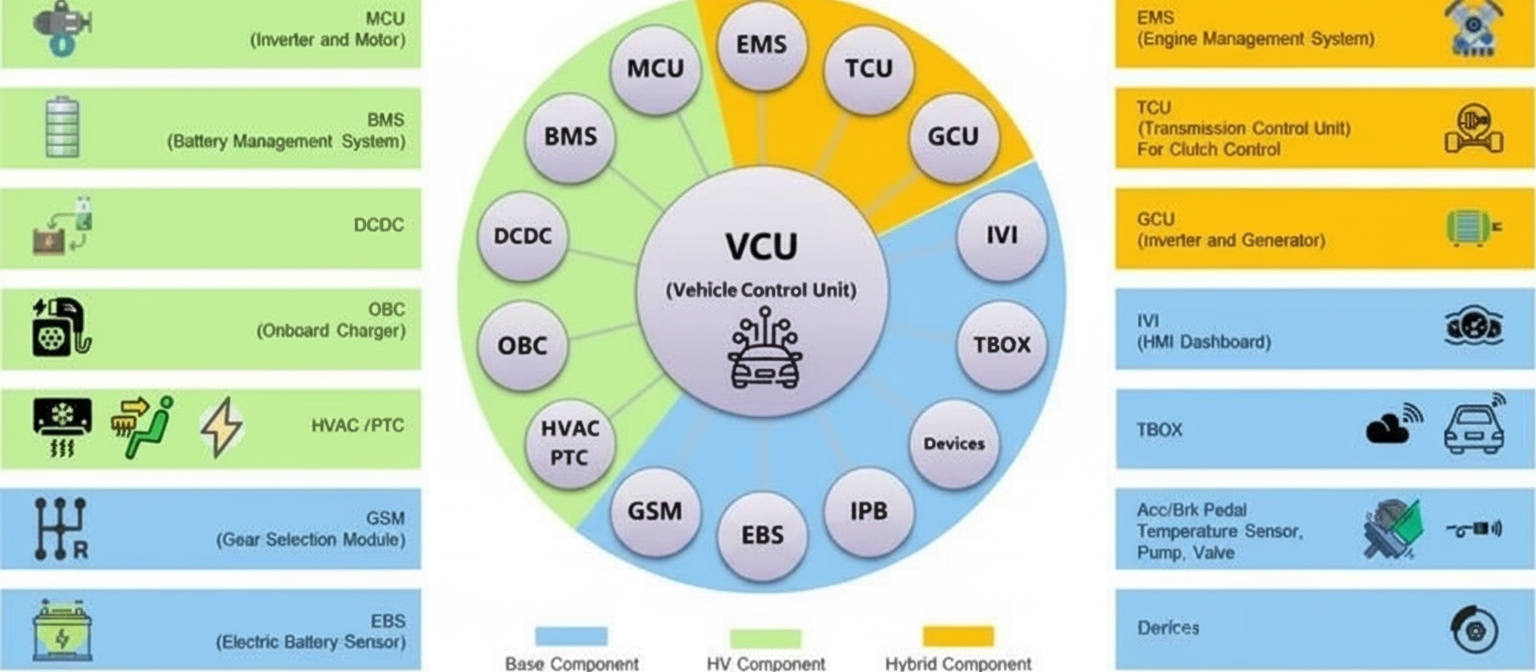

Integration Driven by E/E Architecture Evolution and Cost Control

One-chip multi-function solutions are the future trend for cockpit products. Traditional approach was one-chip one-function: independent central, instrument, and audio systems each driven by a separate chip. As domain integration and screen counts rise, complexity in interconnection, coordination testing, and wiring increases. Integrated one-chip solutions can reduce latency and performance issues from multi-chip communication, simplify debugging, and lower system costs.

Seat-domain compute is transitioning from MCU-based solutions to high-integration, higher-compute SoCs. Current domain controller hardware typically uses a "SoC + MCU" approach: the MCU handles interfacing and basic display functions running AUTOSAR, while the SoC runs isolated operating domains. Safety-critical domains run QNX or Linux for real-time and safety, while infotainment runs Android for ecosystem compatibility. As the computational core for one-chip multi-screen solutions, SoCs that support multi-system execution, high compute, safety, and reliability are in demand.

In-Domain Fusion: Compute Explosion and Heterogeneous Multicore Architectures

To address multi-sensor fusion, multimodal interaction, and multi-scenario use, cockpit SoCs must increase compute capacity. As infotainment systems integrate rich internet content, rapid processing of video, images, and audio raises efficiency requirements beyond CPU-centric designs. Cockpit processors will be heterogeneous multicore SoCs combining CPU, GPU, and domain-specific accelerators (XPU) to handle different tasks.

Cockpit SoCs require balanced compute for HMI and interaction functions and therefore have more comprehensive compute profiles than many autonomous driving chips. Demand and compute growth are mutually reinforcing: demand drives long-term compute growth, while a few leading vendors pursuing differentiation can accelerate compute jumps.

Before 2018, cockpit SoC compute grew steadily; after 2018 it enabled many new use cases. Typical targets today are CPU performance of 60–70k Dhrystone MIPS and GPU performance around 500 GFLOPS. A larger compute jump is expected around 2024–2025, followed by steadier growth. Higher levels of autonomous driving could further increase in-cabin compute demand.

Research suggests on-board compute supply could increase nearly tenfold by 2025 compared with 2015, driven by sensor fusion and multimodal interaction requirements.

As cockpit user experience targets align with smartphone-level responsiveness, legacy 28nm cockpit chips will struggle to meet compute needs, prompting development of advanced-process SoCs by both domestic and international vendors.

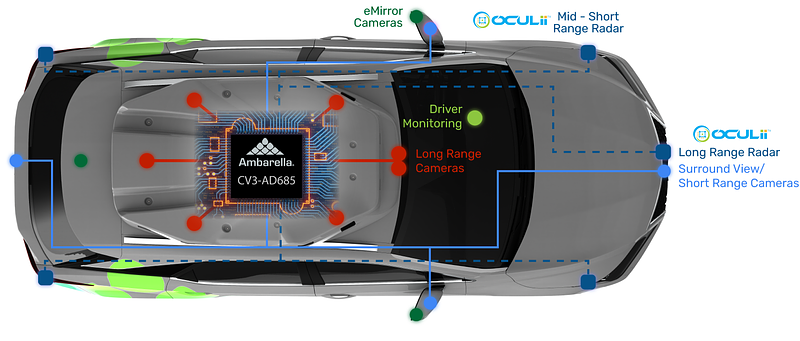

Cross-Domain Fusion: Toward Centralized Compute SoCs

As vehicle E/E architectures evolve from domain controllers to centralized vehicle computers, cross-domain fusion controllers are emerging. Cockpit and parking/driver domains are converging. Several Tier 1 suppliers and chip vendors have released next-generation centralized compute SoCs to meet this trend.

Short-term hardware solutions still use multiple SoCs across boards for reliability and maturity reasons. Long term, centralized compute architectures could enable cockpit and driving SoCs to converge into single-SoC solutions.

Market Growth: Shipments and Value Increasing

Volume: Smart cockpits are becoming a new consumer necessity. As cockpit intelligence is relatively achievable and clearly impacts user experience, new-vehicle cockpit configuration penetration is rising rapidly. Data indicates by 2025 global and China cockpit smart configuration penetration could reach about 59% and 78%, respectively.

According to IHS Markit, the global smart cockpit market could reach US$68.1 billion by 2030, and the China smart cockpit market could reach RMB 166.3 billion. Higher penetration and domain consolidation will increase per-vehicle SoC demand and drive a rapid growth phase for the market.

Value: Additional screens and emerging applications raise SoC compute and value per vehicle. Traditional cockpit configurations were instrument plus central display; new features such as passenger entertainment, central rearview displays, HUD, and rear-seat screens, along with XR/VR and generative AI applications, increase SoC compute and value. Automakers prioritize system-level cost reductions over single-chip cost, and limited supplier options give cockpit SoC vendors bargaining power, so short-term price declines are unlikely. Cockpit SoCs are difficult to down-specify, supporting continued market growth.

Analyst forecasts indicate the global cockpit SoC market could reach US$5.12 billion by 2025 with a five-year CAGR around 20.2%, and the China cockpit SoC market could reach US$2.37 billion by 2025 with a five-year CAGR around 23.5%.

Domestic (China) Vendors and a Window of Opportunity

Cockpit SoC development has long cycles (3–5 years), short product life cycles, lower initial volumes, and higher risk, making it a high-barrier market. Supply is divided between traditional automotive chip vendors and consumer-electronics-focused SoC vendors. Established automotive vendors emphasize cost control and often remain on mature nodes (16–28nm), addressing mid-to-low-end models. Consumer-electronics SoC vendors have advantages from advanced process experience and Android ecosystem adaptation, making their advanced-node SoCs mainstream in mid-to-high-end models.

China-based SoC vendors have accelerated cockpit SoC development since 2021, launching self-developed products and roadmaps. Because domestic vendors started later, their current market share is below 10%, leaving significant potential for localization.

Analysts expect traditional automotive chip vendors' cockpit SoC share to decline over time, while consumer-electronics and emerging cockpit SoC vendors continue to gain share. If domestic cockpit SoCs reach performance parity with leading international solutions, China-based vendors could increase market share due to supply-chain and information-security considerations.

Winning Strategy: Cost-Effective Performance, Local Support, and Robust Ecosystem

Leading cockpit SoC vendors must offer first-tier performance while helping OEMs reduce system costs. Cockpit domain controllers favor high-performance, consumer-like SoCs and therefore require vendors to maintain competitive performance to stay relevant.

OEM cost reduction efforts mean cockpit SoCs should enable more functionality for the same system cost or the same functionality at lower cost. System-level cost, not single-chip cost alone, is the primary consideration.

Vendors should strengthen downstream support to shorten development cycles and meet differentiated OEM requirements. In a software-defined automotive environment, collaboration with OEMs and Tier 1s is critical. Platformized, extensible chip designs with flexible IP combinations improve reusability, reduce development costs, and enable faster adaptation to diverse OEM architectures.

Building a healthy software and hardware ecosystem is essential. A well-adapted OS, middleware, applications, algorithms, and solution platform reduce OEM development time and accelerate model ramp. Cockpit SoC vendors should also monitor trends in autonomous-driving chips and domain MCUs to prepare for cross-domain fusion and centralized compute architectures.

Representative Vendors

Qualcomm

Qualcomm's automotive revenue grew rapidly from FY2020 through FY2023 H1, reaching US$903 million in FY2023 H1 with a three-year CAGR near 46%. Qualcomm consolidated its automotive offerings into the Snapdragon Digital Chassis, covering assisted and automated driving technologies along with infotainment and connected-car services.

Xinch Technology

Xinch Technology, founded in 2018, focuses on high-performance, high-reliability automotive-grade chips. The company reports multiple R&D centers and field offices and offers products across cockpit, ADAS, central gateway, and high-performance MCU categories. Xinch's automotive-grade chips are in volume production, serving hundreds of customers and many vehicle programs, with cumulative shipments exceeding two million units.

Xinch reports international-level automotive production experience and holds certifications including ISO 26262 functional safety process and product certifications, AEC-Q100 reliability certifications, and national cryptographic and information-security certifications.

For cockpit SoC, Xinch released the X9 series, an automotive processor combining high-performance CPU, GPU, AI accelerator, and video processors to support one-chip multi-screen applications across instrument, center display, electronic mirror, entertainment, DMS, 360 surround, ADAS, and voice systems. The X9 family integrates PCIe 3.0, USB 3.0, gigabit Ethernet, and CAN-FD, and includes a safety island with dual-core Cortex-R5 lockstep for critical safety scenarios. The X9 series has achieved production design wins across multiple domestic OEMs.

Xinqing Technology

Xinqing Technology, founded in 2018, operates R&D and sales branches across several Chinese cities and focuses on advanced automotive electronic chips. In early 2023, Xinqing announced volume production of its "Longying-1" chip, a production automotive-grade SoC fabricated on a 7nm process. The chip targets rich infotainment and cockpit experiences, supporting digital clusters, HUD, 4K displays, large 3D games, AVM, DMS, and OMS.

"Longying-1" is described as a high-performance, high-integration, low-power SoC capable of replacing multiple discrete chips and supporting cockpit-parking integration. A dual-chip cascade design can further scale performance. The SoC includes independent functional safety and information security islands. A production vehicle using dual "Longying-1" chips was reported to provide CPU performance of 200k DMIPS, GPU performance of 1800 GFLOPS, and 16 TOPS of AI, enabling advanced cabin features and L2-level parking assistance.

Jiefa Technology

Jiefa Technology focuses on automotive electronic chips and related systems. Its AC8015 cockpit SoC has secured multiple OEM design wins and is deployed in one-chip multi-screen, single LCD instrument, central display, and high-end infotainment systems across 20+ vehicle programs. As of June 2023, AC8015 shipments exceeded one million units.

Analyst coverage and vendor comparisons indicate an active competitive landscape with both international and China-based firms accelerating SoC development for intelligent cockpits.