Overview

This article analyzes the strategic logic and implications behind Dongbo Intelligent's deployment of flat-wire motor automation for new energy vehicles, and examines potential growth opportunities.

After nearly three years of rapid expansion, China's lithium battery industry slowed in 2023 and entered a new industrial cycle. Multiple changes across the value chain are testing the strategic adaptability of all companies in the ecosystem.

In the lithium battery intelligent equipment segment, suppliers face reduced orders as the power battery sector cools, while battery manufacturers demand process innovations, higher efficiency, energy savings, and advanced intelligent manufacturing capabilities. Competition is intensifying as downstream price pressure persists.

In response, intelligent equipment companies are opening new directions. Some strengthen system integration by connecting upstream and downstream processes; some enter higher-value core processes to pursue new technologies; others expand into adjacent sectors such as energy storage, photovoltaics, and key components for new energy vehicles.

Dongbo Intelligent's Positioning

Industry reporting notes that Dongbo Intelligent has established a solid base in 3C digital equipment and is extending into power and energy storage battery fields with core process equipment such as module pack lines and liquid injection machines. In March 2023 the company founded Dongbo Intelligent Equipment (Changzhou) Co., Ltd. to develop automation equipment for flat-wire motors used in new energy vehicles.

Depending on stator winding techniques, flat-wire motors are produced along several routes: I-pin, U-pin (hairpin), X-pin, and W-pin. I-pin and U-pin are currently mainstream because their processes are more mature. X-pin and W-pin offer better performance and cost advantages but have higher technical barriers; these are seen as the next-generation evolution of flat-wire motor winding technology.

Dongbo Intelligent has accumulated years of automated winding technology and mass-production experience. It is among the few suppliers in China capable of delivering mature full-line automation solutions for I-pin and U-pin flat-wire motors, as well as manufacturability and mass-production solutions for next-generation X-pin and W-pin flat-wire motors.

Deploying equipment for flat-wire motors in new energy vehicles extends Dongbo Intelligent's strategic footprint and creates a new basis for evaluating the value of its businesses.

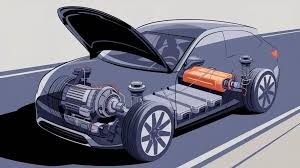

Why Flat-Wire Motors Are Replacing Round-Wire Motors

Flat-wire motors have become increasingly favored in the new energy vehicle market. As global EV penetration rises and competition intensifies, OEMs continually introduce competitive models to capture market share.

As a core component of the powertrain, motor performance strongly influences vehicle performance. Upgrading motor technology is therefore a key way for EV makers to improve competitiveness.

Compared with conventional round-wire motors, flat-wire motors offer higher slot fill factor, higher power density, better efficiency and overload capability, and reduced volume, weight, noise, and cost. These characteristics align with trends toward smaller, more integrated, and higher-power-density EV drive systems, accelerating adoption.

Data shows that in 2022 shipments of flat-wire motors for new energy vehicles exceeded 2.7 million units, up about 28% year-on-year, and market share rose rapidly above 47%.

Public information indicates major OEMs are moving aggressively: BYD invested in multiple flat-wire production lines and plans to use flat-wire motors across passenger vehicles; Tesla has used flat-wire motors across its lineup since 2021; other OEMs including GAC Aion, SAIC, XPeng, NIO, Li Auto, Aito, Changan, Wuling, and Volkswagen have announced transition plans.

Industry forecasts expect that as flat-wire technology matures, motor electrics in EVs will become predominantly flat-wire, with penetration exceeding 90% by 2025. This trend will drive demand for flat-wire motor automation equipment while rapid technical iteration across production line processes will sustain equipment demand growth.

Because the manufacturing process is complex and equipment precision requirements are high, large-scale flat-wire motor production relies on specialized high-end equipment. X-pin and W-pin industrialization still face bottlenecks, and currently many automation systems used in China are imported. High import costs are creating demand for domestically mature mass-production equipment solutions.

Many Chinese companies can produce I-pin and U-pin flat-wire stators, but relatively few can deliver complete automated production lines and successful project delivery. Even fewer have broken through X-pin and W-pin mass-production automation.

Dongbo Intelligent is one of the domestic suppliers capable of full-technology-line automated production equipment for I-pin, U-pin, X-pin, and W-pin flat-wire motors. Its advances on X-pin and W-pin manufacturability have filled a domestic technical gap.

Overcoming X-pin Mass-Production Bottlenecks

Dongbo Intelligent provides automated full-line solutions covering feeding modules, O-type paper insertion machines, O-type paper expansion and inspection machines, hairpin forming machines, pre-insertion visual inspection, card insertion machines, vision-equipped flip units, flaring machines, twisting machines, pre-weld visual inspection, trimming and laser welding machines, weld inspection machines, TIG welding machines, flipping units, BUSBAR TIG welding machines, coil testers, stator dimension inspection machines, varnish and powder coating machines, final testers, and other stations.

The company states it understands the full stator manufacturing flow and the characteristics of different winding types, and has extensive experience with laser paint removal, copper wire forming, twisting heads, laser or TIG welding, varnish application, and performance testing. Dongbo can support customers with winding design, manufacturability analysis, and mass-production support for all winding types.

In the paper insertion step, Dongbo uses servo motors paired with mechanical cam drives to automatically feed, form, cut, and insert insulation paper into stator slots. The system adapts to stators with different slot counts and rotor diameters, ensuring accuracy, consistency, speed, and high automation.

In hairpin forming, the company employs flexible, high-efficiency machines with automatic feeding, straightening, paint removal, vacuum handling, and cutting, combining 2D forming, 3D Z-axis forming, and full 3D forming, plus high-voltage wire damage detection, and automatic insertion into transfer fixtures. Dongbo has also developed a five-axis final forming process.

For flaring, servo-controlled stroke and multiple grippers work simultaneously for efficient and adjustable flaring distances.

For twisting, Dongbo supports separate twisting for 2-, 4-, 6-, and 8-layer flat copper wires, with torque controlled by servos. Each layer's torque, twist angle, and direction are independently controllable.

For laser welding, a flexible laser welding architecture integrates an advanced machine vision guidance system to significantly improve welding reliability and first-pass weld yield while preserving enamel insulation from heat damage. The solution also ensures weld coverage area and saturation to support motor performance.

In insulation processing, electrical tests are performed before varnish application. Visual inspection checks stator dimensions and varnish temperature is precisely controlled to ensure filling rates during varnish deposition.

Dongbo Intelligent reports it has achieved batch trial production for X-pin and has developed manufacturable mass-production equipment for W-pin flat-wire motors.

Technical Breakthroughs for X-pin

X-pin evolved from I-pin and U-pin, with distinct forming processes, weld head shapes, and welding techniques. Its advantages include reduced end-turn size compared with existing flat-wire processes, lowering volume and cost. X-pin stator production also avoids the need for a surfacing/trimming step, further saving equipment cost.

Since its introduction in 2022, X-pin has attracted strong industry interest and leading firms have been developing automated mass-production solutions.

Dongbo states it has overcome key pain points for automated X-pin stator production:

- Forming the end geometry: Removing traditional trimming creates uneven weld reference planes among pins, causing low weld yield and high scrap. Limited welding space and proximity to insulation pose additional welding challenges. Dongbo developed innovative solutions for multiple rupture-cut morphologies to enable continuous production with required consistency.

- Automated wire insertion: Many lines still use semi-automatic or manual insertion. Dongbo offers a fully automated insertion station that supports stable, high-speed line operation.

- Twist consistency: Incorrect twisting increases scrap and affects later welding and insulation. Dongbo redesigned twist and welding fixtures with high-performance CNC programs to precisely control each layer's independent rotation and twist, ensuring consistent copper wire alignment and protecting enamel and insulation paper.

- High-efficiency laser welding: Inconsistent upstream processes such as end geometry, insulation, and twisting affect first-pass weld yield. By ensuring upstream consistency and delivering optimal parts to the welding station, Dongbo's vision-guided flexible laser welding achieves substantially higher one-pass weld yields.

Notably, winding methods for flat-wire motors continue to iterate to achieve better performance in smaller spaces and at lower cost. W-pin is another evolution path.

Dongbo notes W-pin's main challenge is wire forming. Front-end winding exits and later product changeovers result in poor equipment compatibility. W-pin must solve rapid wire-form changeover through a redesigned wire forming architecture, which increases cost and currently suits small-scale trials.

Dongbo reports it has also developed an automated mass-production solution for W-pin.

Implications and Market Outlook

Stator process choice depends heavily on the winding design driven by the electric drive architecture; the wire exit method determines downstream process feasibility and manufacturability. This underscores the importance of an R&D team's understanding of winding types, technologies, and processes.

Dongbo Intelligent's X-pin full-line automated solution represents a notable technical breakthrough and could become a benchmark for automation in the new energy motor industry.

The trend toward flat-wire motors is widely accepted in the industry. Between 2024 and 2025, flat-wire motor market penetration is expected to rise rapidly, driving demand for automation equipment. New processes such as X-pin and W-pin will create additional equipment demand.

Dongbo's mature mass-production solutions for I-pin and U-pin, together with its early achievements in manufacturable mass-production for X-pin and W-pin, position the company to benefit from the next phase of technological evolution in EV motors and expand its market potential.

Conclusion

Dongbo Intelligent is providing automation solutions for two core new energy vehicle components: batteries and motors. On batteries it supplies core process intelligent equipment; on motors it offers full-line automation for flat-wire motors. The company is upgrading its product matrix, expanding market presence, and strengthening its competitive position in the new energy sector.