Introduction

Automotive E/E architectures are continuously evolving. Huawei's CCA architecture (compute+communication) points to future trends in this area.

Key trends driving E/E architecture evolution

1) ADAS function upgrades drive higher compute requirements. In the era of intelligent vehicles, traditional distributed ECU architectures cannot meet growing compute demands and are shifting toward functional-domain centralization.

2) Under the "software-defined vehicle" trend, OTA upgrades require software to adopt a SOA architecture. Traditional distributed software architectures make rapid iterative OTA updates difficult; SOA is needed to enable a new software framework.

3) Vehicle networks are migrating from CAN/LIN to Ethernet to meet bandwidth and communication protocol needs. Ethernet's high bandwidth is suited to large data transfers in intelligent vehicles and is becoming the preferred backbone network. Support for SOME/IP helps enable SOA-style, service-oriented software architectures.

4) Higher compute requirements plus SOA software upgrades drive functional-domain consolidation and make zone-based control an important component.

5) Huawei proposed the CCA architecture: a combination of functional-domain and zone consolidation that guides future E/E architecture development.

Domain controllers and smart actuators

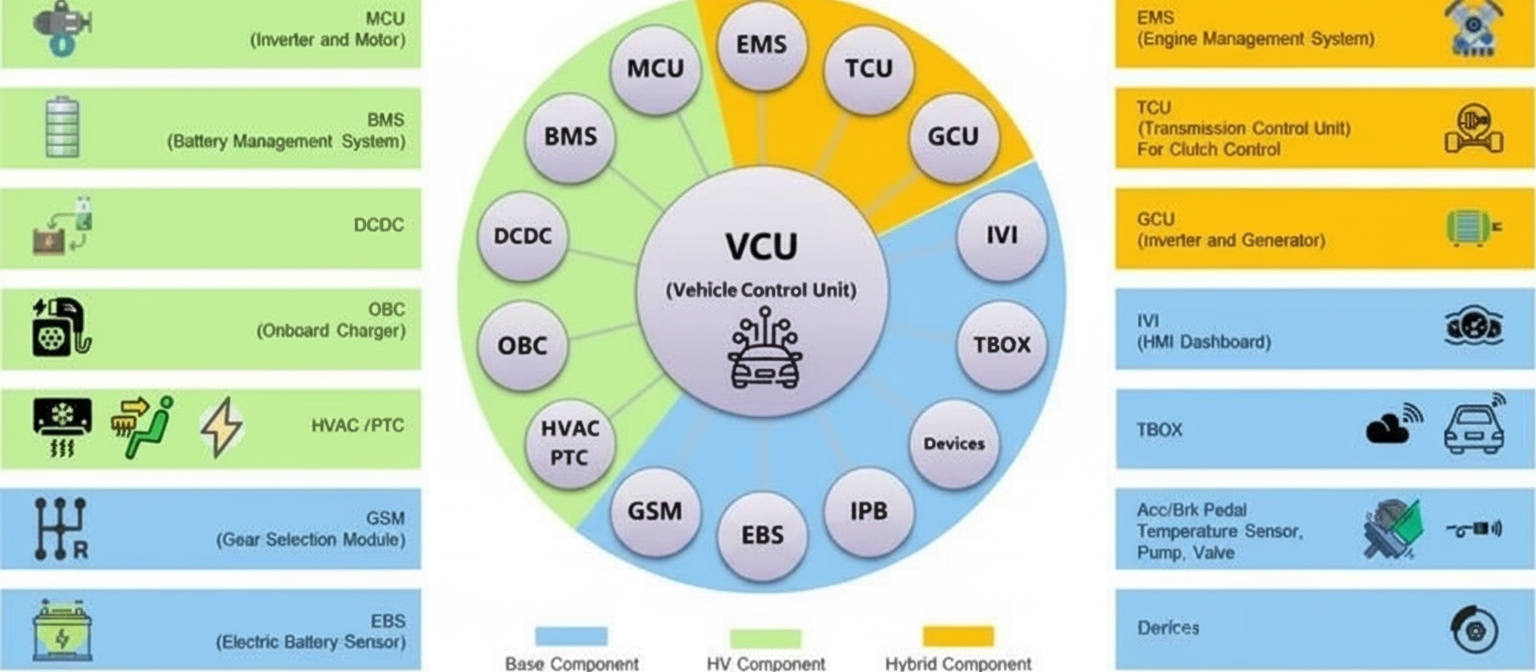

Under the functional-domain consolidation trend, demand for domain controllers increases. Zone controllers push electromechanical products toward standardized smart actuators.

Demand growth for domain controllers mainly comes from the autonomous driving domain, smart cockpit domain, body domain, and chassis domain. Specifically:

- Autonomous driving domain has the highest per-vehicle value, exceeding CNY 10,000, with accelerating penetration expected.

- Smart cockpit domain is not safety-critical for driving and therefore its penetration grows faster than the autonomous driving domain controller.

- Body domain controllers further integrate functions originally handled by BCMs.

- Chassis domain controllers integrate drive, steering, braking and other chassis actuators to enable unified vehicle motion control, creating opportunities for independent chassis actuator suppliers.

Zone controllers bring local algorithm processing closer to connected controllers, and electromechanical products evolve into smart actuators.

Electrification and intelligence: synchronous growth of domain and actuator controllers

Electrification and intelligence accelerate introduction of next-generation E/E architectures within roughly one to two years for many OEMs. Consumer demand for autonomous driving and smart cockpit features, together with continuous feature iteration, will increase penetration of the four major domain controllers. Electrification and intelligent features will also increase penetration of lamp controllers, electric water pump controllers, solenoid valve controllers, electric compressor controllers, and intelligent chassis actuator units.

Estimated market scale for domain controllers reaches CNY 108.7 billion in 2025 and CNY 230.7 billion in 2030. The autonomous driving domain controller market is estimated at CNY 46.8 billion / CNY 124.0 billion for 2025/2030; smart cockpit domain controller market at CNY 29.2 billion / CNY 62.0 billion; body domain controller market at CNY 23.4 billion / CNY 19.8 billion; chassis domain controller market at CNY 9.4 billion / CNY 24.8 billion. Actuator-end controller market size grows to CNY 27.4 billion in 2025 and CNY 31.8 billion in 2030.

1. ADAS upgrades increase compute demand

Rapid improvement of driver assistance features drives evolution from distributed architectures to functional-domain centralized architectures. Traditional distributed ECUs face significant challenges in the electrification and intelligentization era because ADAS functions are expanding rapidly.

- Compute resources across individual ECUs cannot be coordinated, causing redundancy and waste.

- Numerous embedded OS instances and application code are provided by different Tier 1 suppliers with varied programming styles, making unified maintenance and OTA upgrades difficult.

- Distributed architectures require extensive internal communication, increasing wiring harness cost and assembly complexity.

Therefore, a shift from distributed ECUs to functional-domain centralized architectures is a prevailing trend.

2. SOA and OTA: software-defined vehicle requirements

Compared with traditional vehicles, OTA updates enable rapid software iteration for vehicles. In the software-defined vehicle era, OTA (over-the-air) updates meet the need for fast software iteration, avoiding inefficient dealership-based updates and enabling continual feature rollout and user experience improvements.

Traditional distributed ECU software and hardware architectures make vehicle-level OTA inefficient. Typical issues:

- Many ECUs developed by different suppliers use different software frameworks, making third-party developer updates difficult.

- Using CAN/LIN buses, signal routing is statically fixed; updating signal configurations often requires simultaneous gateway updates.

- Signals are nested among controllers; upgrading a single controller may require upgrading multiple related controllers, increasing workload exponentially.

SOA (service-oriented architecture) becomes the trend to realize software-defined vehicles. SOA treats different functional units as services connected by well-defined interfaces and contracts. Each controller exposes its capabilities as services; services are atomic and support dynamic publish/subscribe relationships.

With a central compute E/E architecture and Ethernet connectivity, controller functions are decomposed into atomic services and recombined to implement composite or workflow services. Advantages include:

- Hardware and software separation reduces development complexity;

- Flexible software deployment and function redistribution;

- Loosely coupled services that are easier to maintain;

- Standardized service interfaces that do not depend on specific hardware platforms.

Under hardware-upgradeable conditions, atomic service capabilities can be extended by hardware additions. For example, adding hardware for a digital mirror introduces a digital mirror service that can be combined with reverse-view services to display parking images on the digital mirror.

Framework standards and hardware/communication enable SOA

SOA has mature applications in the Internet IT industry, but in automotive it required mature standards, hardware architectures and communication protocols. Under the intelligent electrification trend, SOA is becoming the next-generation vehicle architecture upgrade direction.

3. AUTOSAR standards: Classical and Adaptive

AUTOSAR (AUTomotive Open System ARchitecture) was established by OEMs, suppliers, and software, electronics and semiconductor companies to create open industry standards for automotive E/E systems to reduce design complexity and improve flexibility. AUTOSAR aims to establish a layered architecture, provide methodologies for application development, and define interface specifications.

3.1 Classical AUTOSAR for traditional ECUs

Classical AUTOSAR (CP) addressed pain points in traditional ECU development, including lack of hardware abstraction, poor software portability across suppliers, and low software reuse. CP standardizes ECU development flows, file formats and code conventions. It establishes software layers to abstract hardware interfaces and drives, with communication via the RTE middleware.

AUTOSAR software is structured into four layers: Application, RTE, Basic Software (BSW), and the microcontroller hardware layer. BSW is further divided into MCAL, ECU abstraction, services, and complex device drivers. The RTE implements the Virtual Function Bus (VFB) interface, providing communication services between software components and between components and BSW or components on other ECUs. Application software components (SW-Cs) are modular and hardware-agnostic, enabling reuse across different ECUs.

3.2 Adaptive AUTOSAR for high-performance ECUs

CP addresses embedded ECU needs but cannot meet ADAS demands for complex software with high compute requirements. Driven by rising compute demands, Ethernet development, and multicore heterogeneous high-performance processors, AUTOSAR introduced Adaptive AUTOSAR (AP) to support SOA.

AP is not an upgrade of CP but a new standard using SOA design. Compared with CP, AP supports 64-bit and higher performance chips while CP targets 32-bit and lower microcontrollers. CP's RTE supports static communication defined at release time and uses signal-oriented LIN/CAN communication. AP's communication module ara::com provides interfaces for service-to-service communication and includes SOME/IP, a service-oriented protocol supporting service discovery and dynamic publish/subscribe mechanisms, enabling dynamic install/uninstall/upgrade similar to desktop software.

AP characteristics include soft real-time behavior with millisecond deadlines, support for functional safety up to ASIL-B or higher, and suitability for multicore dynamic OS environments. While AP has lower hard real-time guarantees than CP, it greatly enhances support for high-performance compute and connected applications.

4. Hardware and communication upgrades: CAN/LIN to Ethernet, signal-oriented to service-oriented

4.1 Bandwidth requirements drive vehicle network evolution toward Ethernet

Autonomous driving requires fast acquisition and processing of large data volumes; traditional vehicle buses cannot meet low-latency, high-throughput needs. Sensor, controller and interface counts are increasing, and autonomous driving demands large amounts of data for real-time analysis and decision-making.

For example, a LIDAR can generate roughly 70 Mbps, a camera about 40 Mbps, and a radar about 0.1 Mbps. An L2 vehicle using 8 radars and 3 cameras can require throughput exceeding 120 Mbps. Fully autonomous systems require even greater bandwidth, which traditional vehicle buses cannot support.

Ethernet, with wider bandwidth and low latency, is a leading candidate for the in-vehicle backbone. Automotive Ethernet connects electronic components with benefits such as higher bandwidth, lower latency, lower electromagnetic interference and lower cost. Early Ethernet required 2–4 pairs of twisted pair and had poor EMI resilience, limiting adoption. BMW first used Ethernet for diagnostics in 2008. In 2011, Broadcom, NXP and BMW established the OPEN Alliance; by now it has 500+ members.

The 100Base-T1 automotive Ethernet standard released in 2015 uses a single twisted pair, reducing connector cost by 70–80% and weight by over 30% while meeting EMC requirements. With 1000Base-T1 and higher NGBase-T1 standards, Ethernet is positioned as the future backbone for intelligent vehicles.

4.2 Service-oriented communication protocols support SOA

SOME/IP is a service-oriented middleware over IP that supports SOA upgrades. Introduced by BMW in 2011 and included in AUTOSAR 4.1, SOME/IP operates at the OSI session layer and enables service-oriented communication. Unlike CAN/LIN's signal-oriented communication where senders transmit regardless of receiver need, SOME/IP enables demand-driven transmission, reducing unnecessary bus traffic.

With SOME/IP and Ethernet, communication architectures support SOA, treating control algorithms and display functions as services accessible through APIs and middleware.

5. Functional-domain consolidation and zone control

Compute demand and SOA architecture support functional-domain consolidation. Under distributed E/E architectures, rising ECU counts increase wiring and weight; distributed ECUs have limited resources and struggle to support ongoing SOA-driven feature expansion. Thus, controllers consolidate into functional domains.

Zone controllers enable local access and flexible expansion, reducing wiring harness length and cost and becoming a key E/E architecture component.

6. Huawei CCA architecture: compute + communication

6.1 Industry progress

Leading OEMs are advancing functional-domain integration; Tesla pioneered zone integration. Many production models follow a Bosch-inspired E/E route and integrate domain controllers for autonomous driving, cockpit and body, while still relying on CAN/LIN for inter-vehicle communication (e.g., Volkswagen MEB platform, Changan CIIA E/E architecture).

Tesla integrated zone controllers early, dividing body controllers into left, front and right zones with local nodes and partial ECU function integration, though controllers remained connected via CAN/LIN.

6.2 Huawei's CCA proposal

Leveraging ICT expertise, Huawei proposed a full-stack solution based on a "compute+communication" CCA architecture that uses an Ethernet ring as the vehicle communication backbone to integrate functional-domain and zone-level control.

The architecture uses an Ethernet ring plus VIU (Vehicle Interface Unit) zone controllers. The vehicle network sets up 3–5 VIUs; sensors, actuators and some ECUs connect locally to VIUs, which provide power distribution, electronic fusing and I/O isolation. VIUs connect via a high-speed Ethernet ring to ensure efficient and reliable vehicle networking.

On top of the communication layer, three domain controllers—cockpit domain controller (CDC), motion/autonomous driving domain controller (MDC), and vehicle domain controller (VDC)—manage entertainment, autonomous driving, vehicle and chassis control functions.

Huawei's Ethernet networking experience supports the implementation of in-vehicle Ethernet solutions. According to industry data, Huawei held a 39% share of China's Ethernet switch market in 2019, which supports near-zero packet loss and microsecond-level latency for in-vehicle Ethernet and VIU implementations.

7. How controllers evolve under new E/E architectures

7.1 ECUs as functional control cores

ECUs are key devices for vehicle function control. They typically include an MCU, power chip, communication chips, input and output processing circuits, and they process sensor, switch and control signals to command actuators such as valves, motors and pumps.

Functions include signal reception and parsing, logic decision-making, network communication, fault diagnosis and handling, and device addressing.

7.1.1 ECU numbers increase as vehicle E/E functions upgrade

In traditional vehicles, each function often required a separate ECU. With increasing E/E functions, ECU counts rise. Strategy Analytics indicates an average of about 25 ECUs per vehicle, while some high-end models exceed 100 ECUs. The number of CAN and LIN nodes has grown, with LIN node CAGR around 17% and CAN node CAGR about 13%.

7.1.2 Controller complexity and value vary by function

Controller complexity increases with signal processing and output control demands. Examples of per-unit value ranges:

- Simple drive controllers (e.g., oil pump): CNY 10–20.

- Controllers with bus diagnostics (e.g., blower controller via LIN): CNY 40–50.

- Complex function controllers (e.g., lighting controller via CAN with multiple controls): CNY 80–100.

- Highly complex controllers (e.g., body control or engine control with many inputs and outputs): CNY 200–400.

7.2 Domain controller consolidation increases demand

In the software-defined vehicle era, central high-compute units are required. The E/E architecture is evolving toward Ethernet+SOA, and the combination of high compute and rapid software iteration is driving distributed ECUs to integrate into domain controllers such as autonomous driving, cockpit, body and chassis domain controllers.

7.2.1 Autonomous driving domain controller: highest per-vehicle value

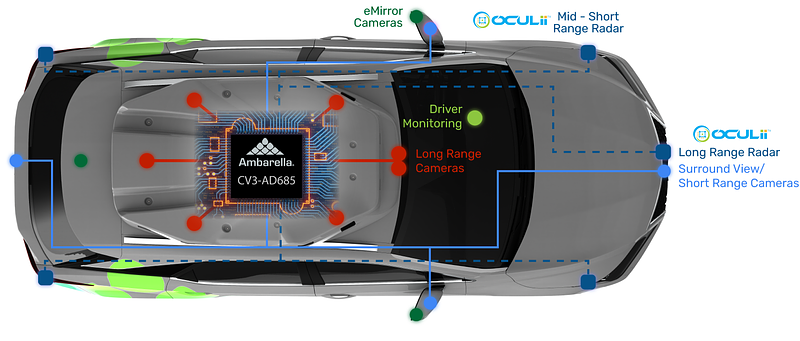

The autonomous driving domain controller is the fastest evolving and most significant integration. It fuses data from cameras, ultrasonic sensors, millimeter-wave radar, lidar and combines high-precision maps and navigation to make driving decisions and output vehicle control commands.

Audi's zFAS pioneered domain integration by combining ADAS ECUs into a single autonomous driving controller in the Audi A8, using a heterogeneous chip solution for perception, fusion, communication and graphics. Current first-tier suppliers for AI compute in autonomous driving include NVIDIA, Mobileye and Huawei, with Qualcomm and Horizon as other notable suppliers. Tier 1s such as Aptiv, Visteon and Continental are accelerating domain controller offerings. Domestic suppliers have also introduced domain controllers; examples include Desay SV's IPU03 using NVIDIA Xavier for XPeng P7 and Huawei's MDC 810 used in the BAIC ARCFOX αS Hi.

7.2.2 Smart cockpit domain controller: early integration

Cabin systems have evolved through mechanical, electronic and now intelligent stages. The smart cockpit domain controller centralizes displays such as digital instrument clusters, center displays, HUD and digital mirrors to implement multi-screen and unified control. Tier 1s worldwide offer smart cockpit domain controllers—for example, Visteon SmartCore and other solutions deployed in various production vehicles.

7.2.3 Body domain controller: BCM evolution

Body domain controllers extend BCM functionality to include sunroof, window, door lock, interior lighting, seats, tailgate, lighting, wipers and PEPS (passive entry passive start). Tesla’s 2019 architecture changes on Model 3 introduced region-based integration with left, front and right RCMs that integrate many body functions and some HVAC/thermal modules, reducing harness length, weight and cost by localizing nodes.

Successful Tier 1s in the body domain should have strong BCM experience, independent module development capabilities for windows and HVAC, strong hardware integration, software architecture competence including AUTOSAR and SOME/IP experience, and chip supply capability commensurate with company scale.

7.2.4 Chassis domain controller: opportunities for chassis actuator suppliers

In the electric intelligent era, chassis control is moving to by-wire systems. Because of the lack of vacuum sources, energy recovery requirements and higher control precision, chassis actuators are migrating to X-by-wire solutions including electronic braking and steer-by-wire. OneBox electronic brake solutions have per-vehicle value around CNY 2,000 and steer-by-wire around CNY 3,000, roughly doubling traditional actuator value. Chassis actuator integration creates opportunities for independent suppliers to provide unified drive, brake and steering algorithms where OEMs seek more open suppliers.

7.3 Zone controllers and the evolution of electromechanical products into smart actuators

In Huawei's CCA architecture, 3–5 Vehicle Interface Units (VIUs) are key nodes on the high-speed ring network. Sensors, actuators and ECUs around the vehicle connect locally to VIUs, which provide:

- Power supply for local sensors, actuators and ECUs;

- Electronic fusing to replace traditional relay-fuse schemes, enabling targeted shutdown of noncritical functions under battery constraints and reducing conductor gauge;

- I/O isolation from compute units, allowing data conversion and aggregation at the zone level and exposing data to the Ethernet network, facilitating software abstraction and hardware hot-swap;

- Integration of some ECU functions into the zone controller for simple edge compute tasks, improving processing efficiency (e.g., blower control, audio).

Zone controllers virtualize physical I/O and expose them as services over a high-reliability Ethernet network. Initially, zone controllers use standardized software modules and interoperate with existing ECUs via CAN/LIN by converting data into Ethernet formats. Over time, zone controllers will absorb more ECU functions, enhance capabilities and reduce ECU counts. Huawei estimates that adopting a CCA architecture on a CNY 300,000 vehicle could reduce ECU count from 38 to 28 (a 26% reduction), shorten harness length from 3.2 km to 2.6 km (17% reduction), lower harness cost from CNY 3,000 to CNY 2,500 (19% reduction), and reduce weight by about 7 kg.

Under zone controller architectures, ECU functions are elevated to zone or higher-level domain controllers. Zone controller-connected devices become intelligent sensors and actuators such as electric water pumps and solenoid valves. Their controllers focus on drive and diagnostic functions and become standardized components.

8. Market outlook under electrification and intelligence

Electrification and intelligent features drive faster penetration of domain and zone controllers and increase the number of actuator-end microcontrollers. Domain controller penetration within 1–2 years will depend on OEM E/E update speed and demand for L2.5+ autonomous driving and advanced smart cockpit features.

Many OEMs planned next-generation E/E architectures for rollout: BMW iNext ix, Geely SEA for Zeekr 001, Mercedes EVA/EQS, Toyota e-TNGA BZ4X, Great Wall GEEP3.X Mocha, SAIC IM new E/E platform, and others targeting SOA deployments between 2021 and 2022.

Intelligent feature penetration and EV market share increases will raise controller market demand. Using a dataset of 30 notable electric models, penetration of L1–L2 AD functions among new EV makers exceeds 70%, while traditional OEMs lag behind. EV market share rose from 2.7% in 2019 Q4 to 12.2% in May 2021. With rising smart feature penetration and EV share, the controller market is expected to grow.

Estimated domain controller market size in 2025/2030:

- Autonomous driving domain controller: assuming 2025 penetration at 20% as PA (L2) and CA (L3) reach over 50% combined, and 2030 penetration at 50% as PA(L2)/CA(L3) exceed 70% and HA(L4) reach 20%, market size is CNY 46.8 billion / CNY 124.0 billion for 2025/2030.

- Smart cockpit domain controller: penetration estimated at 50% / 100% for 2025/2030, market size CNY 29.2 billion / CNY 62.0 billion.

- Body domain controller: per-vehicle value estimated at CNY 1,000 in 2025 and CNY 800 in 2030; market size CNY 23.4 billion / CNY 19.8 billion.

- Chassis domain controller: synchronized with autonomous driving penetration, with integrated braking/steering algorithms increasing value; penetration 20% / 50% in 2025/2030, market size CNY 9.4 billion / CNY 24.8 billion.

8.1 Smart features drive additional controller demand

Vehicle intelligent upgrades increase the share of electronic systems in vehicle cost. Estimates suggest automotive electronics could account for up to 45% of vehicle cost by 2030. Smart headlights and intelligent chassis see notable value increases.

8.1.1 Smart headlights

Lighting has evolved from halogen to xenon to integrated LED to matrix LED to laser and pixel headlights. Control complexity and controller requirements increase accordingly. Halogen required no controller, xenon required ballast, LEDs require current and temperature control, adaptive lighting requires motor and fan control, and pixel/laser systems need more advanced control and higher value.

8.1.2 Chassis electronics

Chassis electronics evolved from longitudinal ABS to ESC for longitudinal and lateral control. With autonomous driving, brake-by-wire and steer-by-wire functions are upgrading. ABS had per-vehicle value around CNY 200–300; one-box brake-by-wire is around CNY 2,000 and steer-by-wire around CNY 3,000. Chassis electronics have high technical thresholds and complex algorithms typically provided by global Tier 1 suppliers such as Bosch and Continental. Chassis domain integration creates opportunities for domestic suppliers to supply integrated algorithms and actuators.

8.2 Electrification and the rise of smart actuators

As vehicles shift from ICE to new energy powertrains, traditional engine-driven accessories must become electric (e.g., electric water pumps, electric compressors). Greater precision requirements for thermal management of cabin and battery drive growth in motor controllers. Under zone controller architectures, control moves up the stack and motor controllers become standardized smart actuators focused on drive and diagnostic functions.

Currently a vehicle may have about 50 smart actuator units; projections suggest around 80 standardized smart actuators per vehicle by 2030. Market sizes for smart actuator modules are roughly CNY 20.2 billion in 2020, CNY 27.4 billion in 2025 and CNY 31.8 billion in 2030.

Summary

Under the new E/E architectures, vehicle controllers are categorized into four major domain controllers—autonomous driving, smart cockpit, body, and chassis—and actuator categories including chassis actuators and standardized smart actuators. Trends toward Ethernet backbones, SOA, domain consolidation and zone-based VIUs drive both domain controller and actuator markets.