Introduction: the rise of the digital cockpit

The automotive industry is undergoing significant change as customer expectations shift. Influenced by smartphone and smart device usage habits, consumers no longer view a car solely as a transportation tool; they now expect an in-vehicle experience that connects with their digital lives. Traditional cockpits are evolving into digital products, giving rise to the digital cockpit.

What a digital cockpit includes

The digital cockpit integrates a set of display technologies, primarily including infotainment systems, instrument clusters, head-up displays (HUDs), and other data output displays such as clocks or temperature indicators. These systems are supported by high-density, multi-layer automotive electronics PCB, which provide the electrical backbone for signal routing, power distribution, and high-speed data communication between cockpit modules.

Before digital cockpits, vehicle data readouts were largely independent and fixed in function. A digital cockpit can link multiple displays—satnav and entertainment information can be shown on the instrument cluster or HUD, and trip or vehicle status info can appear on the infotainment screen. Because displays can access a common central data source, synchronization issues are reduced. A key advantage of the digital cockpit is reconfigurability: drivers can choose what to display and where. For example, in an electric vehicle the remaining range can be shown alongside navigation on the central infotainment screen to help drivers plan charging stops.

Consumers expect richer digital experiences in vehicles regardless of price segment. As vehicle production and sales rise, demand for integrated digital cockpit electronics is increasing.

Historically, cockpit manufacturing cost was about 2–3% of vehicle cost. To deliver luxury, comfort, safety, and advanced infotainment, features such as HUDs, gesture control, voice control, centralized controllers, telematics, and steering controls have been deployed at scale in passenger vehicles. Estimates put digital cockpit costs at roughly 11–12% of total vehicle cost.

Instrument clusters and infotainment systems currently account for about two-thirds of the digital cockpit market demand. According to Grand View Research, the global automotive digital cockpit market was valued at $19.8 billion in 2020 and is forecast to grow at a CAGR of 8.8% from 2021 to 2028.

Driver monitoring systems are a subtype of infotainment that provide interactive functions such as entertainment, navigation, cabin climate control, and safety features including advanced driver assistance systems (ADAS). In 2020, the driver monitoring systems segment led the automotive digital cockpit market with a 48.3% share.

With increasing adoption of Apple CarPlay and Google Android Auto standards, this trend is expected to continue. Major automakers are introducing more capable and complex digital cockpit solutions. Examples include Volkswagen Group and Audi virtual cockpits for models such as the Audi TT and A6, BMW's digital systems, and other automakers targeting advanced cockpit solutions for mid-range and economy models.

Core technologies inside modern digital cockpits

Over the past decade, instrument panels and displays have transformed. New digital cockpits consolidate information on large screens and include user-friendly HMIs, making vehicle control easier.

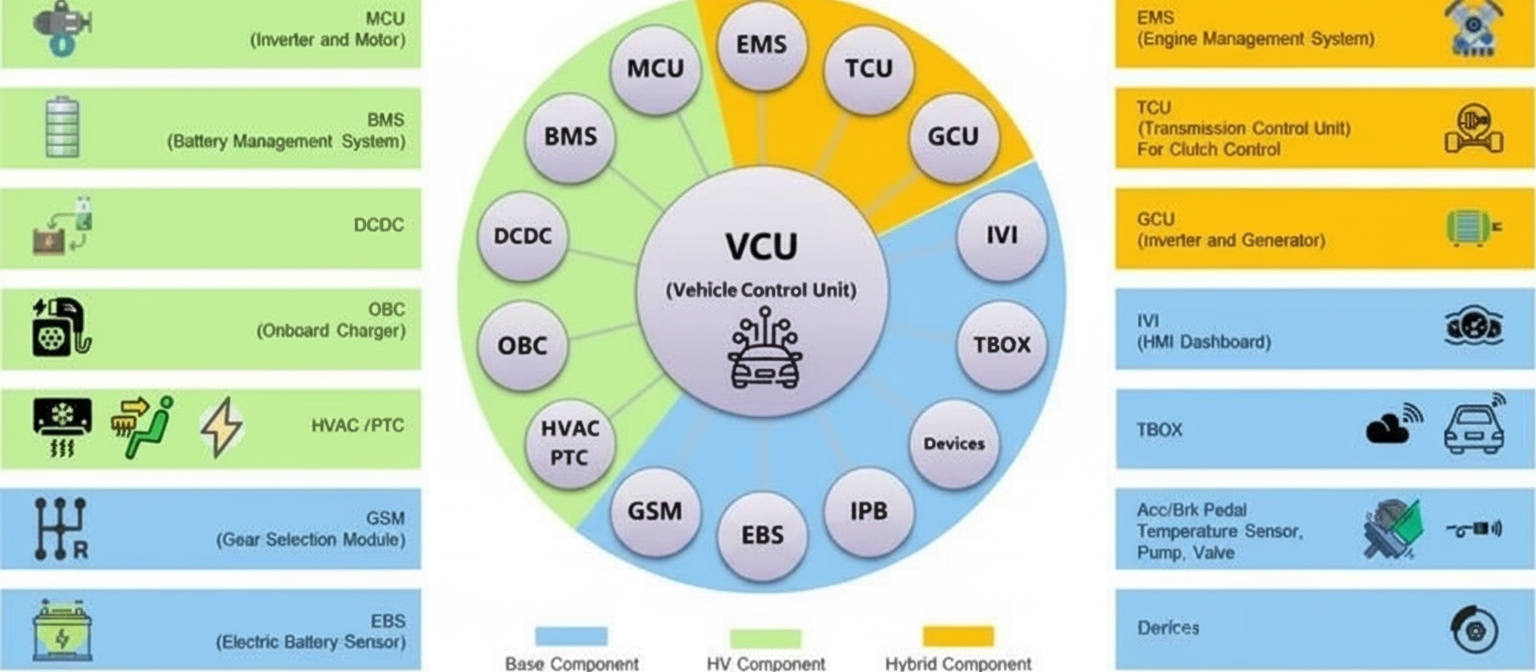

The operation of a digital cockpit depends on integration across vehicle systems, implemented differently by manufacturers. Some use a powerful central compute unit as a hub to drive displays and control units and to coordinate peripheral embedded systems. Others rely on stronger distributed peripherals and de-emphasize a single central computer.

Vehicle networks such as CAN, LIN, FlexRay, and Ethernet bring data from distributed ECUs and sensors into the digital cockpit. To improve the user experience, manufacturers also integrate third-party heterogeneous systems that run as virtualized guests on an automotive hypervisor. Mainstream digital cockpits generally include the following technologies and components.

1. Head-up display (HUD)

Originally used in fighter aircraft, HUDs are now applied in automotive contexts. A HUD is a transparent display that projects information such as speed, navigation cues, and obstacle warnings into the driver's line of sight without obstructing view. Due to cost, HUDs are primarily found in luxury vehicles, but Tier 1 suppliers plan wider deployment across commercial and passenger vehicles.

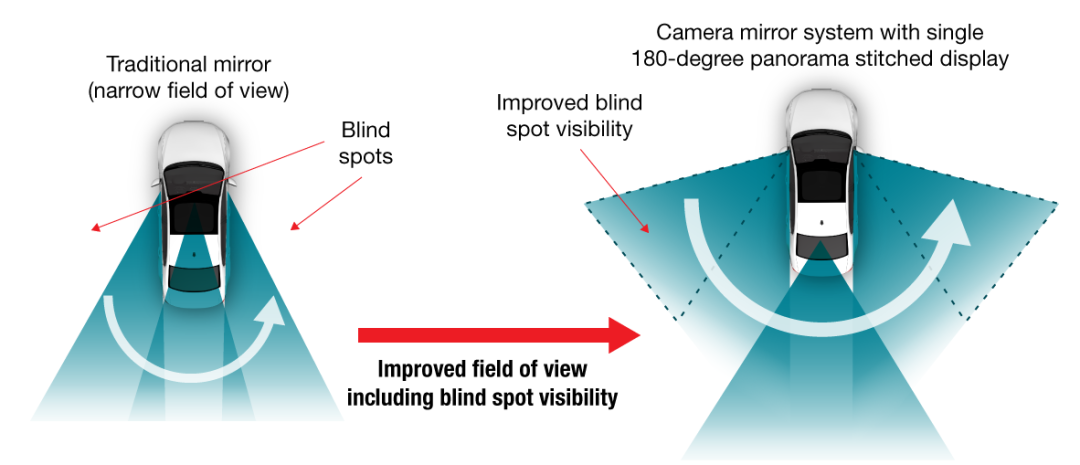

Three HUD types are commonly used in cars: combiner HUD (C-HUD), windshield HUD (W-HUD), and augmented reality (AR) HUD. Longer term, HUD development will move toward 3D HUDs, voice-controlled HUDs, and laser HUDs. AR HUDs use projection optics to present driver assistance data naturally and quickly, allowing manufacturers to place relevant information directly in the driver’s field of view and reduce blind spots.

Image: AR HUD significantly expands driver field of view and reduces blind spots. Image source: Texas Instruments

2. Infotainment system

Infotainment combines information and entertainment. These systems comprise hardware and software that deliver audio and video content and related information. Modern infotainment systems feature high-definition touchscreens and new connectivity options such as Wi-Fi, Bluetooth, and USB. Touchscreens are typically integrated into the dashboard or available for rear-seat use. Infotainment in a digital cockpit allows configurable presentation of different information types based on importance and usefulness.

3. Navigation systems

Automotive navigation uses satellite positioning or a connected smartphone to determine locations. Beyond location guidance, these systems provide nearby services such as hotels, restaurants, hospitals, gas stations, traffic conditions, and preferred routes. They employ machine learning algorithms for analysis and optimization. In a digital cockpit, navigation can appear on HUDs or other A/V displays close to the driver’s line of sight for easy access while driving.

4. Intelligent HVAC controllers

Modern vehicles include heating, ventilation, and air conditioning systems. Temperature was formerly adjusted with mechanical knobs; it is now often managed by an automatic climate controller using thermal sensors. Sensors send temperature data to a programmable controller, which adjusts cabin temperature using control algorithms. Digital cockpits integrate HVAC control so occupants can adjust cabin temperature by voice or other HMI methods.

5. Intelligent voice assistants

Voice assistants allow drivers and passengers to perform hands-free tasks ranging from media control to vehicle function management. In some markets, voice assistants are used in cars more frequently than on smartphones. Embedded voice systems elevate the in-vehicle experience.

Advances in deep learning have made natural language processing and command control practical in the cabin. AI-based speech recognition is now widely applied. CarPlay and Android Auto are examples of connected vehicle operating extensions/apps that connect to dashboard displays via USB, Bluetooth, or Wi?Fi. Many automakers support these platforms for voice-enabled interactions.

6. Digital instrument cluster

Digital instrument clusters present dynamic driving information such as tachometer readouts, function displays, route maps, and rear-view camera video so drivers can monitor vehicle performance in real time and reduce accident risk. Drivers can customize which information appears on each display.

Digital cockpits aim to digitize the entire vehicle cockpit. Next-generation displays will be primarily touch-based. AI advances have broadened control methods—gesture and voice control are common choices. These integrations enable seamless driver-vehicle interaction, allowing drivers to keep their eyes on the road while improving safety and the overall user experience.

Semiconductor technologies driving the digital cockpit

The commercial development of the technologies above depends on enabling semiconductor technologies. Automotive semiconductor vendors compete to provide chips for these systems.

Texas Instruments AWR1443 radar for gesture recognition

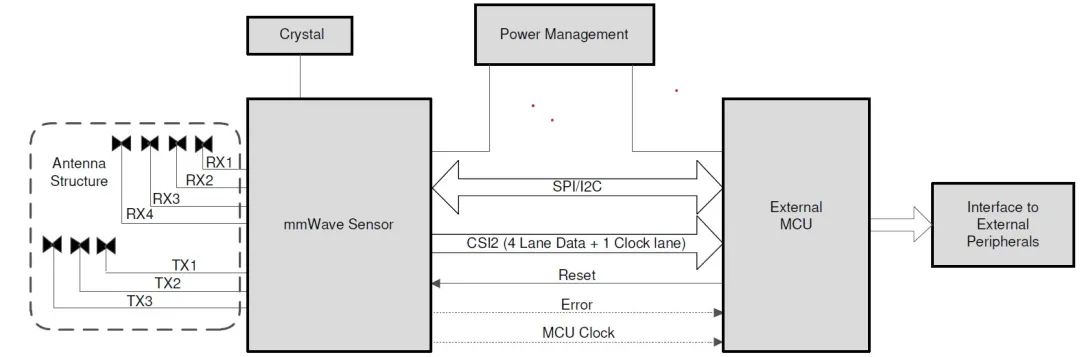

The TI AWR1443 is a highly integrated single-chip FMCW radar sensor operating in the 76–81 GHz band. It integrates a PLL, transmitters, receivers, baseband, and ADCs, offering up to 4 GHz usable bandwidth, four receive channels, and three transmit channels (two can be used simultaneously).

AWR1443 includes an integrated Arm Cortex-R4F processor and a hardware accelerator for radar data processing. The radio control system based on Cortex-R4F also supports process and temperature self-calibration.

To increase accuracy, TI supplements radar-based gesture recognition with 3D time-of-flight (ToF) technology to support a range of gesture resolutions—from fine to coarse—for functions such as map zoom, temperature control, and audio control. TI’s OPT8320 3D ToF sensor is a high-performance, highly integrated system-on-chip for array depth sensing.

Image: AWR1443 autonomous radar sensor application block diagram for gesture recognition, parking assist, and other automotive applications. Image source: Texas Instruments

To support feature-rich output channels such as those in a digital cockpit, in-vehicle data consumption and streams increase significantly. Installing more processors and data links would raise system cost and complexity and increase failure risk. To avoid this, OEMs often rework hardware infrastructure to support centralized in-vehicle infotainment platforms, reducing cost and design complexity. Centralization reduces intermediate components between each input source and output channel, requiring higher data throughput per link and processor and resulting in new in-vehicle infotainment network architectures and topologies. Advanced semiconductor chips play a key role in this transition. TI’s Jacinto processors are an example.

TI Jacinto processors

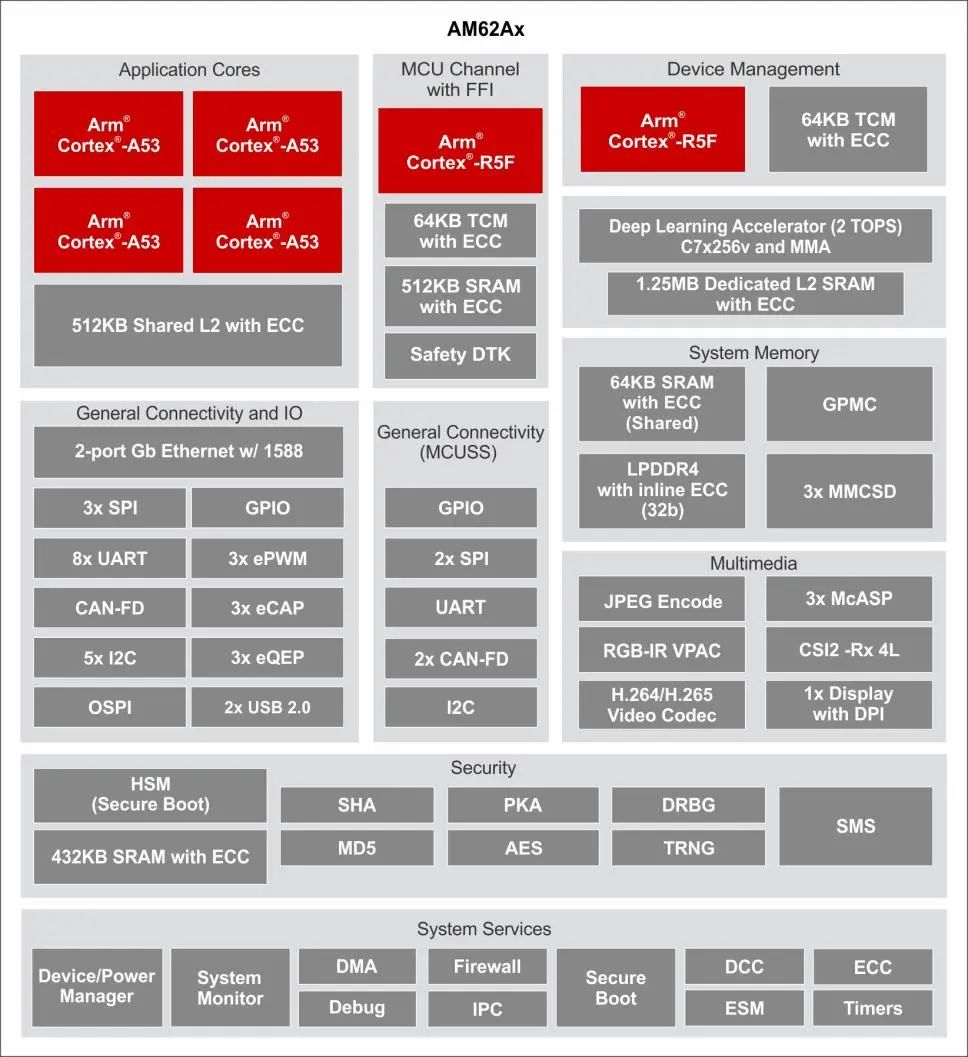

TI Jacinto processors are Arm-based application processors designed for automotive, industrial, and IoT devices, offering efficient edge computing in an SoC architecture. For example, the AM62Ax belongs to the TI Sitara family of automotive-grade heterogeneous Arm processors. It provides embedded deep learning, video and vision processing acceleration, display interfaces, and a broad range of automotive peripherals and network options for cost-sensitive automotive applications including driver and in-cabin monitoring and next-generation eMirror systems.

The AM62Ax includes four 64-bit Arm Cortex-A53 cores, a vision processing accelerator (VPAC) with an image signal processor (ISP) and visual accelerators, deep learning and video accelerators, a Cortex-R5F MCU channel core, and a Cortex-R5F device management core. The Cortex-A53 cores supply the compute needed for Linux applications and vision-based traditional algorithms like driver monitoring. Cost-optimized AM62Ax delivers high performance-per-watt for traditional and deep learning algorithms, offering scalability and lower cost for advanced automotive platforms that consolidate multiple sensor domains into fewer ECUs.

Image: Internal system diagram of the AM62Ax Sitara processor. Image source: Texas Instruments

Software platforms and ecosystem

The future of the automotive industry lies with automated, connected vehicles that feature scalable, fully integrated digital cockpit systems. Analysts estimate that by 2025 most cars in Europe and the United States will have embedded connectivity. OEMs must balance safety, convenience, and cost requirements. Fully in-house development is challenging, so automakers work with specialist service providers for specific technologies.

TomTom’s digital cockpit is an open digital cockpit software platform designed for automakers to integrate users’ digital lives with vehicle functions. The platform unifies passenger and driver displays and provides access to climate control, audio, vehicle settings, and apps via voice and touch.

At CES 2024, the Twine4Car in-vehicle infotainment (IVI) platform and its car-centric app store—resulting from years of collaboration between ACCESS and TomTom—were demonstrated. Twine4Car enables OEMs and Tier 1 suppliers to offer flexible entertainment services including head units, rear-seat entertainment, and video, audio, and gaming experiences.

Conclusion

Today's cars differ greatly from vehicles 20, 10, or even five years ago. Drivers expect their in-car screens to show the same music apps they use on their phones, with high-definition screens and attractive interfaces. They also expect their digital lifestyles to integrate seamlessly into the vehicle. Features that were once aspirational are rapidly becoming standard differentiators for automakers.

The objective of the digital cockpit is to fully digitize the vehicle cabin. Future digital cockpits will be more intuitive, easier to use, visually refined, and tightly integrated with mobile applications. For automakers and suppliers, the future will offer greater customization, deeper integration of ADAS and EV features with navigation, and enhanced personalization and interactivity in the cabin, enabling drivers to remain focused on the road while accessing richer experiences. Digital cockpits will play a central role as vehicles move toward smarter, more personalized in-cabin experiences.