Overview

In the field of display driver chips, continuous technological innovation responds to increasingly diverse and personalized consumer and commercial demands. For smartphone displays, requirements for image quality, screen shape, and active area are becoming more refined. Device manufacturers have advanced technologies such as bezel-less displays, under-screen fingerprint sensors, and curved screens. Chip designers must keep improving refresh smoothness, stability, contrast, and screen-to-body ratio to meet these demands.

In the power management chip sector, a growing variety of display applications combined with customized requirements from different terminal vendors and panel makers has increased the diversity of display power management solutions. With the acceleration of 5G and advanced display technologies, devices such as smartphones, tablets, and laptops trend toward higher resolution, higher brightness, wider color gamut, narrower bezels, longer standby, and greater portability. These trends raise requirements for power management chips in terms of power consumption, integration, efficiency, and tighter control over current, voltage ranges, and energy precision.

In LED display driver chips, as pixel pitches shrink, LED displays are expanding into more application scenarios. Small-pitch LED has enabled LED panels to transition from outdoor to indoor uses; Mini LED is expected to enable LED displays for home applications; Micro LED will focus on near-eye applications such as phones, smartwatches, AR/VR. The expansion of LED applications creates significant market opportunities for LED display driver chip development.

Display driver chips

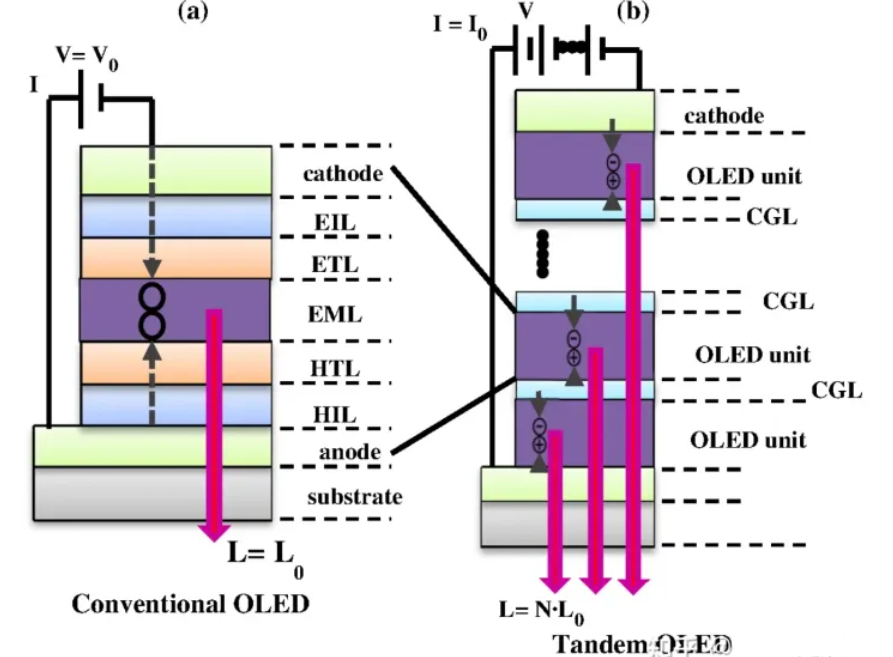

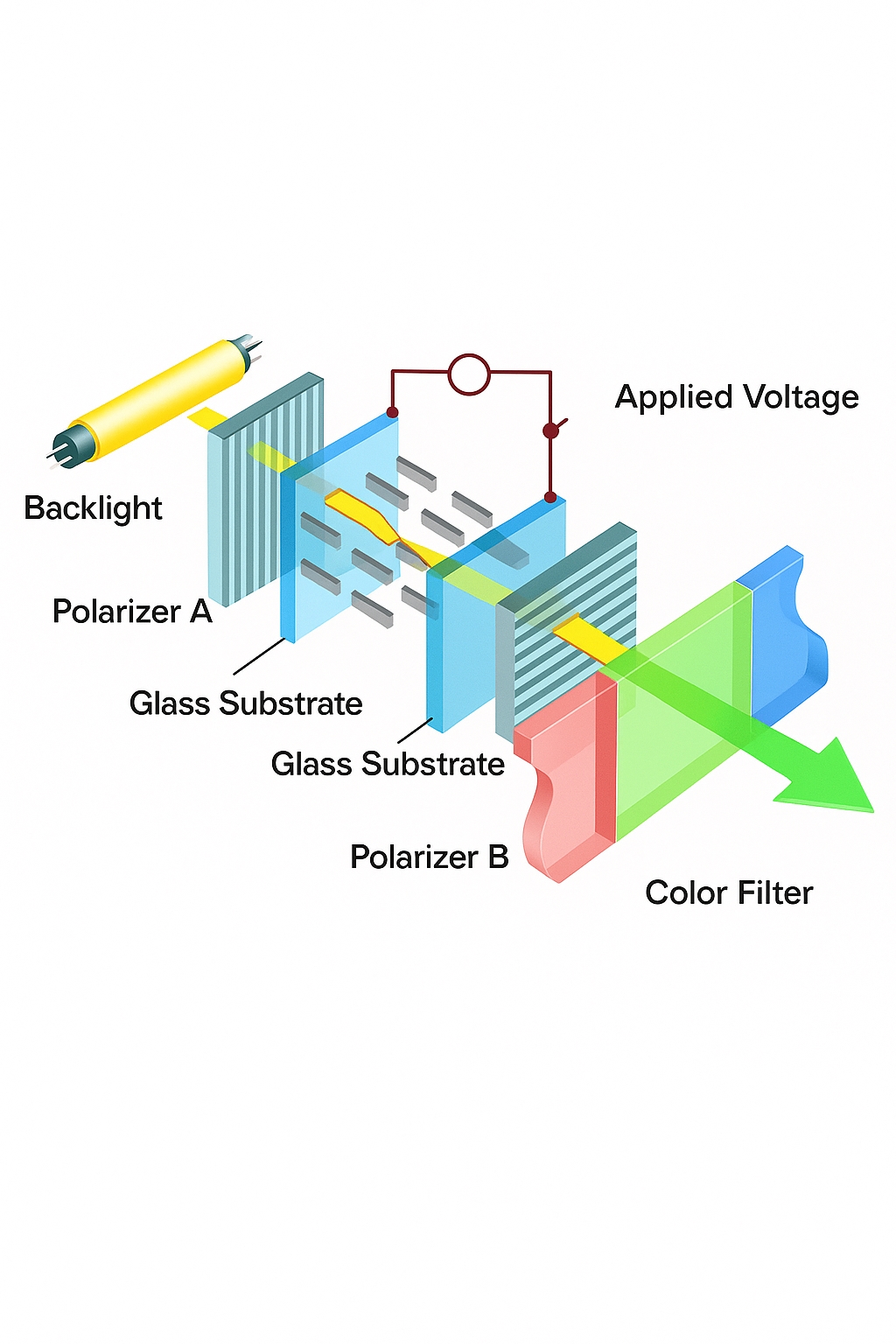

Display driver chips are a core component of display panels. By driving current and voltage they control screen brightness and color to render images. Major panel technologies include LCD and OLED. LCD uses a backlight whose projection and blocking are controlled by the liquid crystal layer, which changes pixel optical transmission through molecular orientation. OLED panels are self-emissive: when current passes through organic light-emitting materials they emit light, and luminance depends mainly on the current through each organic emitting layer.

Medium and large-size LCD panel drivers

Medium and large-size LCD driver chips are mainly used in TFT-LCD panels for TVs, laptops, monitors, and commercial displays. Typically, multiple driver ICs are required for a single panel.

These driver chips include source driver ICs and gate driver ICs. Gate drivers sequentially turn on the TFTs on the panel according to control signals. Source drivers charge the pixel capacitance and storage capacitors to the required voltages to set liquid crystal orientation. Before GOA (Gate on Array) technology matured, panels usually required both source and gate driver ICs. With GOA integration of gate driver circuits on the glass substrate, gate drivers can be moved onto the panel, reducing cost and enabling narrow bezels. Currently, many medium and large panels are driven only by source driver ICs.

Small-size LCD panel drivers

Small-size LCD driver chips are used in smartphone and tablet panels. Due to limited area and volume, typically a single driver IC drives the entire panel, requiring high integration and advanced process technology.

The circuit architecture includes timing control, source drivers, gate drivers, electrostatic protection, and interference suppression circuits. Integrated solutions combine these functions into a single chip. With touch integration on small-panel LCDs, demand has grown for DI-integrated touch. As a result, touch and display driver integration (TDDI) merges display and touch functionality into one IC, enabling thinner, narrow-bezel panels and simplifying process steps compared with discrete MDDI and touch solutions.

OLED panel drivers

OLED driver ICs are used in AMOLED panels. They receive and interpret commands from the main controller, including color, brightness, refresh rate, always-on-display, and sleep states. Drivers consider cutouts for camera or sensors, brightness compensation, and pixel arrangement to process commands and output currents in the required sequence and logic so pixels emit expected luminance and form the target image.

Because OLED panels are self-emissive, driver ICs perform various data processing and compensation to ensure accurate image reproduction and improved quality. This places higher requirements on signal precision, algorithm complexity, and compensation capability.

Power management chips

Power management ICs handle power conversion, distribution, detection, and control, meeting the varied power needs of circuit components and ensuring functional stability and reliability. They directly affect electronic device performance and are essential components.

For display systems, the power management product matrix typically includes PMICs, operational amplifiers (OP), level shifters, and programmable gamma (P-Gamma) chips. These form a one-stop power management solution for panels.

In a panel system, display driver chips and timing controllers require coordinated power supplies. The PMIC performs boost, buck, and positive/negative conversions to provide specific voltages for different components. OPs are high-load operational amplifiers used as voltage buffers to stabilize shared pixel electrode voltages. Level shifters convert low-voltage timing signals from the controller into higher positive or negative voltages to drive panel logic and switch pixels. P-Gamma provides reference voltage levels corresponding to different luminance through DACs and timing control circuits to achieve precise pixel rendering.

LED display driver chips

LEDs are semiconductor devices that convert electrical energy to light, used widely in displays, backlights, lighting, and instrument panels. In full-color LED displays, pixels are formed from many red, green, and blue LEDs. LED driver ICs drive many pixels to display specific images by controlling grayscale contrast and refresh rate.

LED driver chips mainly include constant-current driver ICs (column drivers), row drivers, and logic control chips. Constant-current drivers convert image data into adjustable current amplitude, frequency, or duty cycle to make LEDs emit target colors and brightness. Row drivers control row scanning. Logic control chips act as high-speed CMOS transceivers, receiving control signals from the main controller (MCU/FPGA), boosting drive capability, and outputting signals to the column and row drivers.

Control chips and other components

Control chips include fingerprint sensors, touch controllers, timing controllers (T-Con), and SoCs.

Fingerprint and touch controllers are used in smartphones, tablets, and smart locks. Fingerprint ICs handle image capture, feature extraction, and matching. Touch ICs detect capacitance changes and coordinates, then output touch data to the main controller. T-Con chips are used in medium and large panels for laptops, TVs, monitors, and commercial displays; they convert system input data into data recognizable by driver ICs and supply control signals to source and gate circuits.

Market trends

Display driver chip market

Display driver ICs are central to panel function. Global market size has fluctuated with panel technology trends and downstream demand cycles. From 2018 to 2019 the market declined slightly as GOA adoption reduced gate driver usage in medium and large displays and smartphone shipments softened. During 2020–2021, pandemic-driven demand for home learning and remote work increased panel shipments and lifted driver IC demand. According to Omdia, global demand reached 8.07 billion units in 2020 and 8.88 billion units in 2021, both exceeding 10% year-on-year growth.

Power management chip market

Power management ICs are critical to circuit function and reliability, with broad downstream applications across consumer electronics, automotive electronics, industrial control, appliances, mobile communications, and new energy. According to IC Insights, power management IC shipments ranked first among all chip categories in 2020.

Driven by widespread electronics adoption worldwide and the growth of Industry 4.0, IoT, AI, and new energy vehicles, the global power management IC market has grown steadily. Data from Frost&Sullivan and industry research institutes indicate the market expanded from $19.8 billion in 2016 to $37.0 billion in 2021, with a compound annual growth rate of about 13.3%. The market continued to grow into 2022 and 2023, with estimates projecting further increases.

LED display driver chip market

LED driver ICs are key upstream components for LED displays and their market size closely follows LED display demand. Indoor LED applications have grown rapidly, driving demand for LED driver ICs. Advances such as Micro LED, which reduces pixel size significantly, impose higher performance requirements on driver ICs. With continued penetration of LED displays and display technology progress, demand, performance requirements, and product value for LED driver ICs are expected to rise.

According to TrendForce, the global LED driver IC market grew from $182 million in 2016 to $335 million in 2020, at a CAGR of 16.48%. In 2021 the market surged 116.42% to $725 million due to increased downstream demand and higher chip prices. Projections for 2022–2023 indicate continued growth, with the market estimated to reach $851 million in 2023.