1. Market demand is driving continued output growth

Economic development, improvements to health insurance systems, reforms to the medical service system, and rising public demand for medical services will drive continued growth in medical device consumption. As healthcare reform deepens and hierarchical diagnosis and treatment pilots are implemented, rural township health institutions will become markets with large potential for medical devices. Population aging and higher living standards will accelerate growth in industries such as in vitro diagnostics, orthopedics, and rehabilitation devices. Against the backdrop of stimulated demand and steady economic growth, China’s medical device industry is expected to remain in a rapid development phase.

2. Technological innovation is supporting healthy industry growth

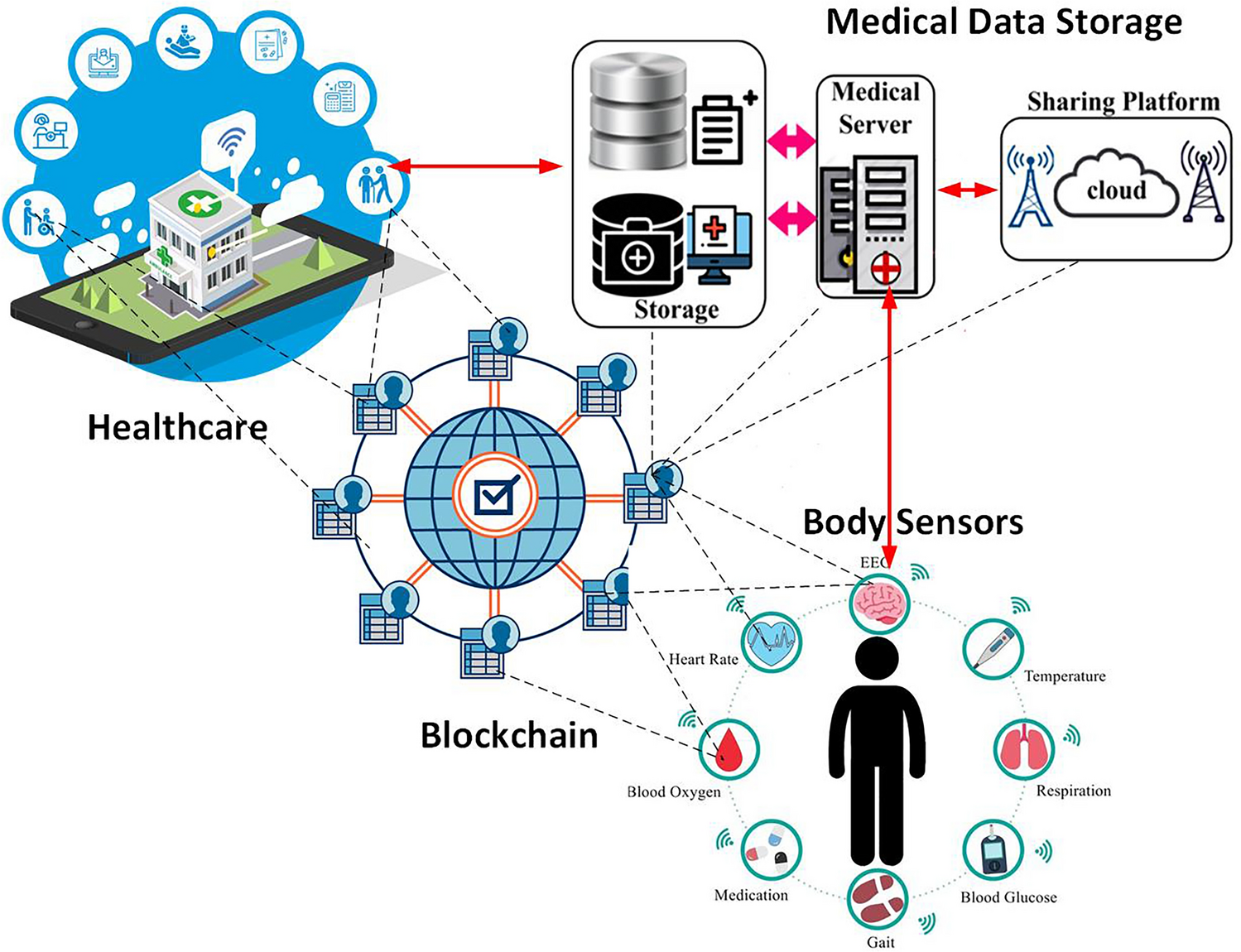

To promote innovation in the medical device industry, China has formulated and implemented a series of science and technology investment plans, providing a platform and foundation for technological innovation. The Chinese medical device industry is gradually forming an innovation system led by enterprises, market-oriented, and integrating production, academia, research, and application.

Major products in China’s medical device field have achieved continuous breakthroughs, with a concentration of innovative results. The industry has achieved a series of important advances described as original innovations, developments from nothing, and upgrades from low to high. A number of digital, smart, and portable innovative medical devices have been applied in primary care institutions. Endogenous innovation capability and innovation vitality in China’s medical device sector have significantly increased, and localization of medical devices is entering a new stage of rapid development.

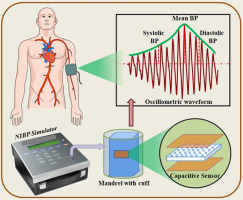

3. High-end medical consumables still rely on imported key raw materials

High-end medical consumables integrate precision mechanical, laser, radiological, nuclear, magnetic, testing, sensor, chemical testing, and biomedical technologies. Competition centers on core processes that incorporate one or more of these frontier technologies. China has become a major manufacturing country globally but is not yet a leading manufacturing power. In the high-end medical consumables sector, the import rate of core raw materials remains high and the capability to develop complementary products is insufficient.

4. Domestic companies lag behind European and US manufacturers in high-end markets

China’s medical device companies still focus primarily on low-technology disposable and small-to-medium products. After nearly 30 years of development, domestic companies can produce the vast majority of common medical device products. The number of Chinese manufacturers with a certain production scale already exceeds the total of many European and US firms, and China has the world’s largest manufacturing capacity for disposable medical devices and low-end equipment. However, large foreign medical device manufacturers possess advanced technologies, strong financing, and concentrated talent. They hold extensive experience in R&D for large, high-end devices and retain core technologies for major high-end products. Leveraging financial resources and brand advantages, they can enter basic medical device markets through acquisitions or OEM arrangements with domestic firms, exerting strong competitive pressure on Chinese manufacturers. In the high-end medical equipment and device market, Chinese domestic firms still lag behind European and US manufacturers.

5. Weak industrial manufacturing base

As division of labor becomes more detailed and market transactions more active, the medical device industry chain has been extended and optimized, with closer ties to upstream and downstream sectors. Upstream industries exert significant constraints on medical device development, especially mechanical, material, and electronic sectors, which directly influence technological directions in medical devices. Compared with developed countries, China’s industrial manufacturing base remains weak, which has become an important constraint on leapfrog development in the medical device industry.

6. Shortage of high-end R&D and manufacturing talent

Medical devices are multidisciplinary, high-tech products involving mechanical, optical, electronic, information, and materials disciplines. Product validation also requires biological evaluation, animal experiments, clinical trials, experimental design, and statistical analysis. High-end innovation requires personnel with multidisciplinary knowledge. Currently, talent in China’s medical device sector is concentrated in sales, maintenance, and regulatory affairs. Compared with developed countries, China has gaps in both the quantity and quality of R&D personnel and precision instrument manufacturing staff. Designers, structural engineers, medical electronic engineers, and polymer R&D personnel are in short supply, which directly affects the industry's ability to improve international competitiveness.

7. Restrictions from foreign non-tariff barriers

Governments impose stringent market access and regulatory requirements for medical devices, such as FDA registration in the United States and CE certification in the European Union. China still has gaps compared with developed countries in production process management and quality assurance systems, and relatively few domestic manufacturers and products have obtained international certifications. China’s medical device exports face a series of non-tariff trade barriers, such as certification and environmental standards. Domestic medical device companies also lack experienced professionals in international market operations and have limited international trade experience, making entry into global markets challenging.