Overview

With the rapid development of artificial intelligence (AI), network communications are undergoing a structural shift. This shift is changing the optical module industry and increasing demand in the optical module market.

AI cluster network architectures are evolving toward higher speed, lower latency, and lossless operation, moving from leaf-spine to fat-tree topologies. This evolution increases demand for high-speed optical modules and results in different module-to-GPU ratios: under PCIe 5.0 with H100 the 800G module ratio is 1:2.5, while under NVLink 4.0 with GH200 it reaches 1:9. These changes imply broader application of optical modules across more scenarios and requirements.

Part 1: Optical Moore's Law accelerates

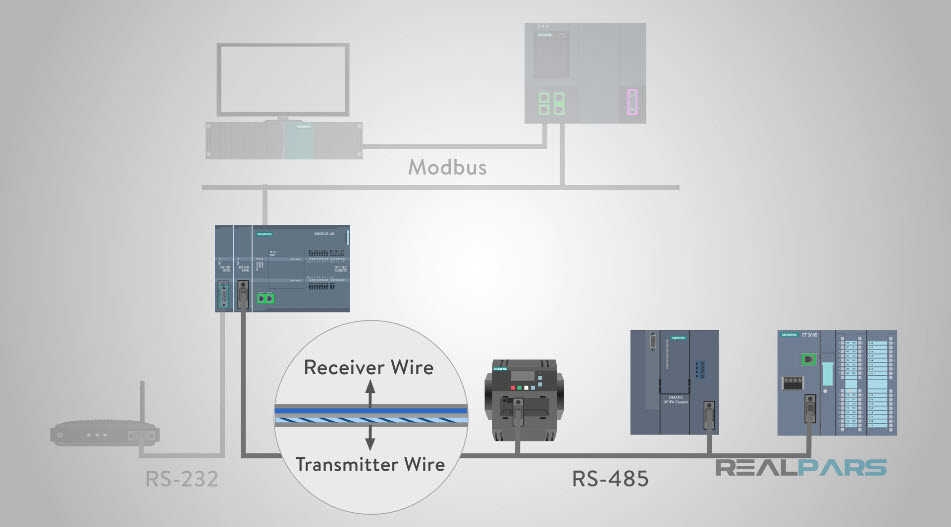

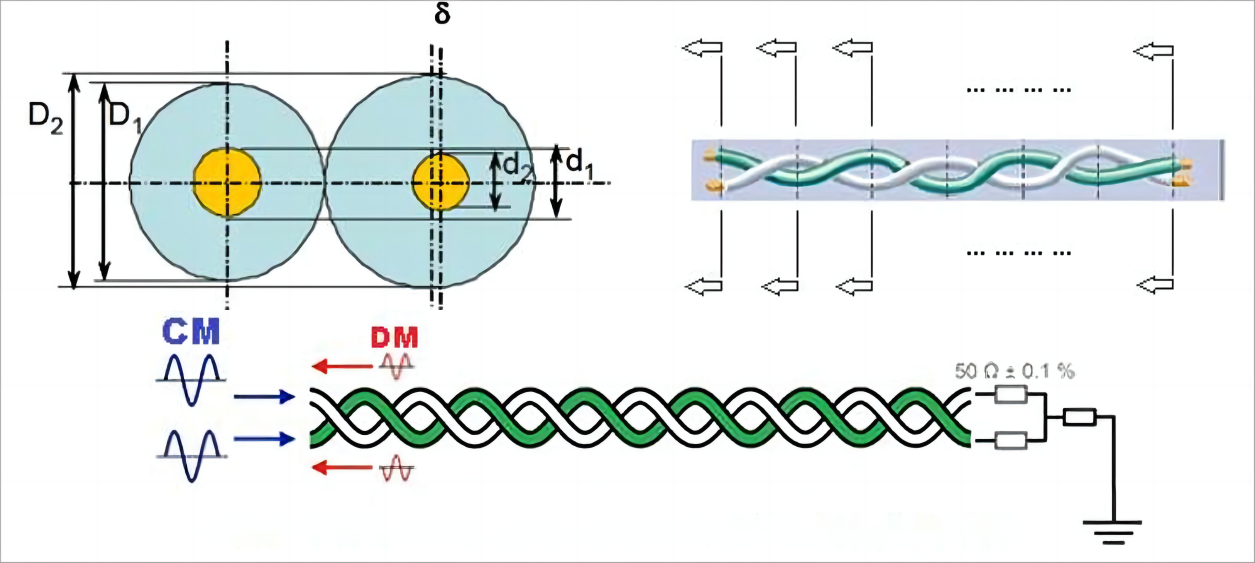

Optical communication, as a high-speed, efficient, and reliable transmission method, is increasingly central to modern communication networks. In optical communication systems, optical modules are the key interface modules that perform electro-optical conversion between equipment and optical fiber, and they play a critical role in optical transport networks.

Optical modules mainly consist of two parts: optical components and auxiliary materials.

- Optical components include optical chips and optical element assemblies and account for more than 70% of module cost.

- Auxiliary materials include housings, pins, printed circuit boards, and control chips, accounting for the remainder.

- The core functions of an optical module are optical transmission and reception.

- The transmitter optical sub-assembly (TOSA) converts electrical signals into modulated optical signals at the required data rate.

- The receiver optical sub-assembly (ROSA) converts optical signals back into electrical signals, enabling bidirectional electro-optical conversion.

Optical modules are widely used in telecom networks, data centers, and AI clusters. In telecom networks they serve fixed-line access, wireless access, and CWDM/DWDM scenarios. In data centers they are used for data center interconnects (DCI). Under AI-driven workloads, demand for optical modules has grown and they are critical to improving the communication capacity of compute clusters.

With explosive growth in information traffic, the optical module market shows significant development potential. Continued investment in AI by major technology companies, and the expansion of data centers and AI clusters, are driving market demand. As AI networks evolve toward multimodal workloads, the application scope for optical modules is expected to expand and bandwidth requirements to increase.

Part 2: Cloud computing and network architecture evolution

As cloud computing and data migration accelerate, data center scale and complexity continue to increase, and evolving network architectures are having a profound impact on optical module demand. These architectural changes are primarily driven by the need to handle surging data volumes, and they directly influence both the quantity and performance requirements of optical modules, as well as the underlying telecommunication PCB used in switches, servers, and optical transceiver hardware.

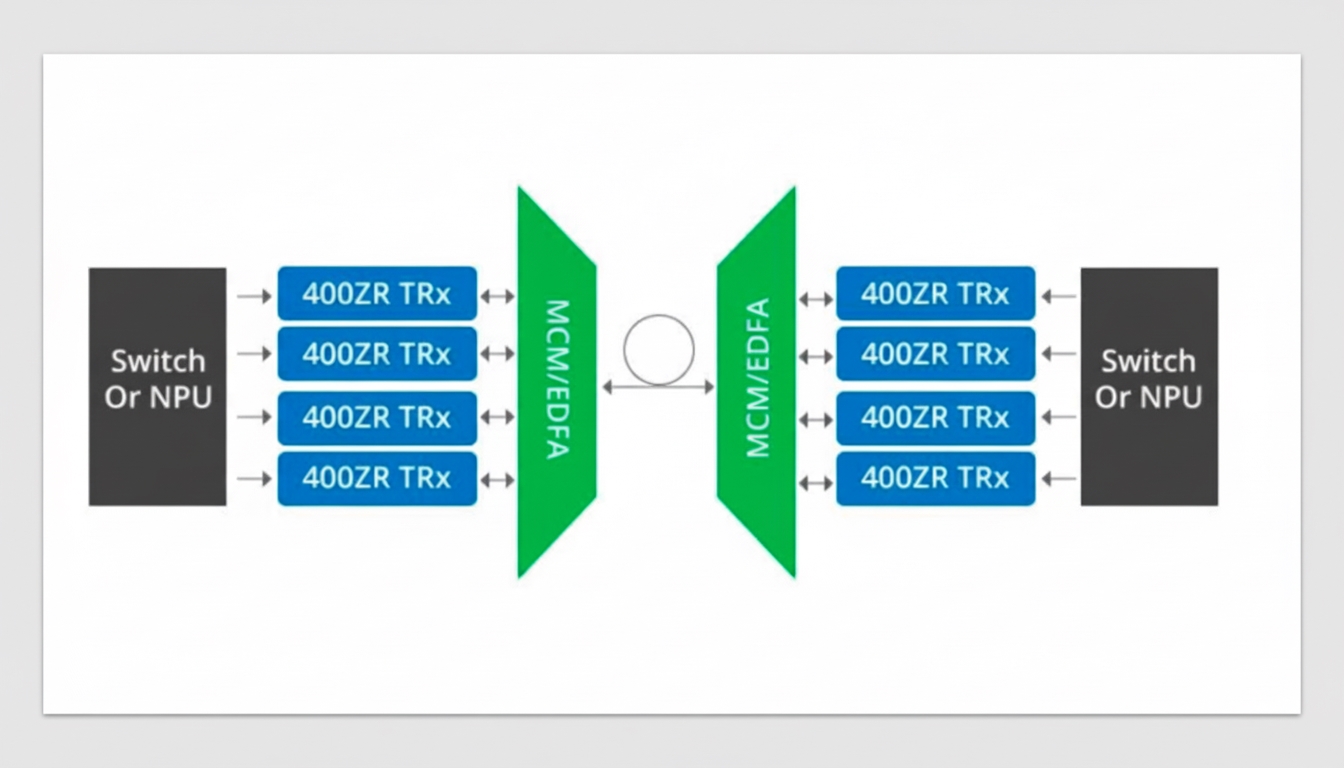

The traditional three-tier architecture no longer meets growing data center traffic demands. Leaf-spine architectures address this limitation. Under leaf-spine designs, the number of optical modules can increase by orders of magnitude to meet the high bandwidth, low latency, and lossless networking requirements of large AI clusters. AI compute centers typically use non-blocking fat-tree architectures.

NVIDIA's network architecture uses NVLink for efficient inter-GPU connectivity. In its DGX A100 SuperPOD, each server hosts eight GPUs connected via a fat-tree network. Considering connections between servers and switches, optical module counts can become very large.

In GPU-centric data centers, GPUs and optical modules are closely related. For example, in GH200 clusters, the number of optical modules per GPU can be notably high. As data center network performance improves, demand for high-speed optical modules continues to rise.

Meta and Google have distinct data center network architectures and corresponding optical module requirements. Meta's Research SuperCluster and Google's TPU array networks illustrate how network design influences optical module demand. Evolution in data center network design directly affects both the quantity and types of required modules.

As data centers evolve and network performance improves, demand for high-speed, efficient optical modules will persist. Optical modules remain a key component of data center networks for stable operation and efficient data transfer.

Summary

Optical modules are a critical component of modern communication networks, forming the backbone of high-speed data transmission and supporting the global digital infrastructure. As cloud computing, hyperscale data centers, and edge networks continue to expand, optical modules play an increasingly central role in enabling low-latency, high-bandwidth connectivity across servers, switches, and storage systems. With ongoing technological development and sustained market demand, their functional scope is steadily broadening beyond traditional telecom applications into data center interconnects and AI-driven computing environments.

In particular, the rapid rise of AI workloads is reshaping GPU to Optical Module Ratios and Demand in AI Networks. Large-scale AI clusters require massive east–west traffic between GPUs, leading to a significantly higher consumption of optical modules per compute node than in conventional data center architectures. As GPU density increases and interconnect speeds move toward 800G and beyond, demand for optical modules is expected to scale accordingly, reinforcing their strategic importance in next-generation AI network infrastructures.