What is Satellite Internet?

Satellite internet has a development history of nearly 40 years, dating back to the 1980s. After an initial phase of direct competition with terrestrial mobile communication networks and a subsequent phase in which it served as a supplement and backup to terrestrial networks, satellite internet is entering a new phase of integrated development with ground networks. Compared with traditional terrestrial internet, satellite internet offers wide coverage, high transmission rates, and strong anti-interference capability. It can provide high-speed, stable internet service to remote areas, maritime regions, aviation, and railways that cannot access traditional networks.

Satellite internet development plays an important role in advancing the digital economy and promoting information infrastructure. It can deliver e-commerce, online education, and healthcare services to rural areas, helping improve incomes and quality of life. It also provides communications support for aviation, space operations, and maritime work, improving operational efficiency and safety. With characteristics of high bandwidth, low latency, and broad coverage, satellite internet can support innovation in broadband access services.

01 System Components

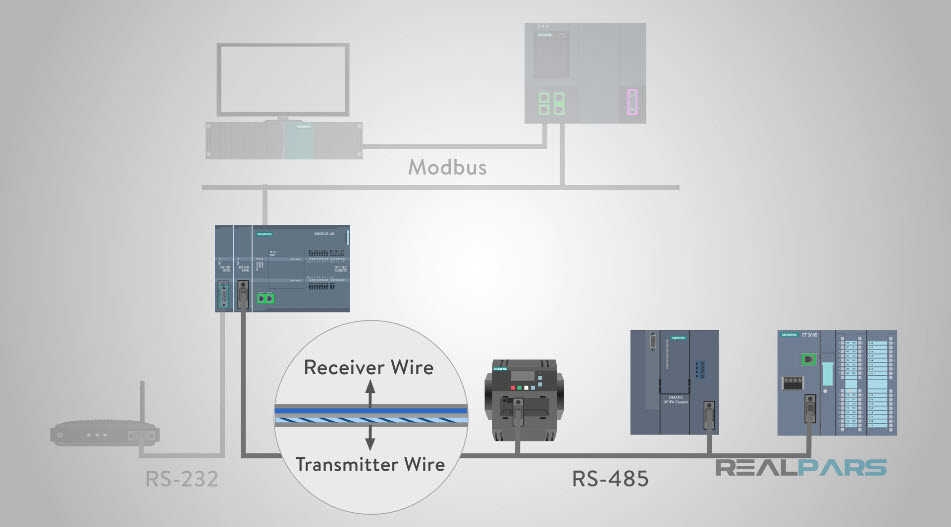

Satellite internet refers to internet access based on satellite communication technology, with services that can cover the globe. By deploying large-scale satellite constellations to form real-time information transmission systems, satellite internet can provide end users with communication services centered on broadband internet access. The reliable operation of these systems depends on high-reliability telecommunication PCB used in both spaceborne and ground-based communication equipment to ensure stable signal processing and power management.

Satellite internet generally consists of three parts: the space segment, the ground segment, and the user segment. The space segment mainly comprises a constellation of communication satellites that receive and relay satellite signals to provide coverage. The ground segment includes satellite telemetry, tracking and control networks and gateway stations, which connect satellite internet with terrestrial communication networks. The user segment includes the various communication terminals used by end users.

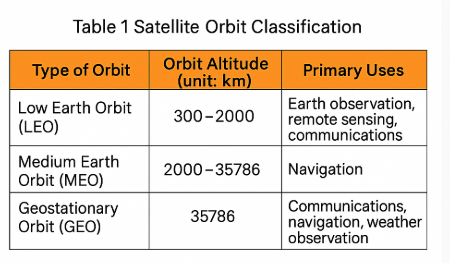

By orbit altitude, satellites are commonly classified into low, medium, and high orbits. Low Earth orbit satellites offer advantages of lower transmission delay, lower link loss, and flexible transmission, making them well suited for satellite internet services.

02 Application Scenarios

Satellite internet supports the following primary application scenarios.

Coverage of dead zones

Satellite internet can effectively complement terrestrial networks such as 5G, providing communications for geographically complex regions such as maritime areas, deserts, and remote mountains, and extending internet coverage to aircraft flight routes.

Military and diplomatic communications

Satellite internet can be used for secure diplomatic communications and for military command, battlefield situational awareness, and space electromagnetic operations.

Low-cost coverage for sparsely populated regions

In areas with large geographic extent and low application density, satellite internet can provide connectivity at lower cost and with faster deployment compared with ground networks composed of fiber and cellular base stations.

Emergency communications for major disasters

When earthquakes, tsunamis, fires, or other major disasters damage or interrupt terrestrial networks, satellite internet can provide cross-regional emergency communications.

03 Current Development Status

International status

Under the ITU Radio Regulations, satellite orbital slots and frequency resources are exclusive and time-sensitive, creating a clear first-mover advantage in constellation deployment.

1. Exclusivity of orbital and spectrum resources

There is only one geostationary orbital ring, which must be allocated among countries through fair coordination. Other orbits, such as low and medium orbits, are allocated on a first-come, first-served basis. Studies estimate that low Earth orbit can host around 60,000 satellites. Considering planned constellations such as Starlink, Kuiper, Samsung's space internet plan, and OneWeb, the combined planned LEO launches already exceed 60,000 satellites. The Satellite Industry Association estimates that the number of in-orbit commercial spacecraft will exceed 100,000 by 2029. From both economic and national strategy perspectives, development of LEO constellations is urgent.

2. Time-sensitivity of constellation deployment

According to ITU rules, satellite operators must launch 10% of their registered satellites within two years of the first satellite entering service, 50% within five years, and complete deployment within seven years. Failure to meet these timelines can result in forfeiture of the allocated resources.

In recent years, many countries have released satellite communication network plans, and commercial space development has accelerated, particularly in the United States. Supported by large technology companies, innovative firms such as SpaceX and OneWeb have launched plans to build constellations of LEO small satellites, initiating a global surge in space-based internet access.

According to publicly available ITU data, about one third of the global population, approximately 2.6 billion people, remain unconnected to the internet. In the least developed countries, about two thirds of the population, approximately 720 million people, are offline. Facing this large market, companies such as Airbus, Amazon, Google, Facebook, and SpaceX have invested in satellite internet, proposing projects like Starlink and OneWeb. As of July 2023, Starlink had launched over 4,800 satellites.

Development in China

Since 2017, China has launched multiple satellite constellation plans, including the Hongyan constellation, the Hongyun program, and the Tianqi constellation. China established the China Satellite Network Group in April 2021 to integrate satellite internet and integrated space-ground systems and to lead system construction and operation; the organization is currently conducting technical studies and testing. Private companies such as Galaxy Aerospace have successfully launched several broadband satellites and are conducting communication system tests. By 2029, an estimated 57,000 LEO satellites may be deployed globally, with the United States expected to account for more than 80% and China projected to rank second in LEO satellite numbers.

In recent years, national authorities have issued multiple policies supporting satellite internet development. Although development in China started later, after being included in the 2020 "new infrastructure" category and recognized as a strategic national project, momentum has increased. Multiple constellation programs are underway, and constellation deployment investment is expected to exceed RMB 30 billion. Based on industry estimates, the satellite networking segment accounts for roughly 8.1% of the overall satellite industry value chain, implying a potential Chinese satellite internet industry scale on the order of RMB 360 billion.

With lower costs, higher network speeds, and improved stability, satellite internet is increasingly applied across power, oil and gas, mining, transportation, and agriculture and forestry sectors.

04 Development Trends

Satellite communications are central to the space economy. Satellite internet development is expected to follow these trends.

Satellite internet elevated to national strategic priority

Because of its growing strategic importance, market potential, and the scarcity of orbital and spectrum resources, many countries have listed satellite internet construction as a major national development strategy and released national-level plans.

Technological advances reduce construction costs

Satellite manufacturing is moving from customization toward standardization and modularization, reducing production costs. Advances in rocket reuse reduce launch costs. Satellite communication bandwidth has increased from hundreds of Mbit/s to Gbit/s, greatly enhancing network capacity.

Competition for spectrum and orbital resources intensifies

International allocation mechanisms, primarily first-come, first-served and equitable planning, face increasing pressure from large-scale constellation deployments. As countries and companies race to deploy thousands of satellites, competition for orbital and spectrum resources is intensifying.

Integration of satellite and terrestrial networks will advance

Satellite internet offers advantages in coverage and robustness during natural disasters, but it also has higher latency and service costs compared with terrestrial networks like 5G. In the near term, satellite internet is unlikely to replace terrestrial networks. Current technical trends indicate that integration of satellite and terrestrial networks will be an important development direction for future mobile networks.